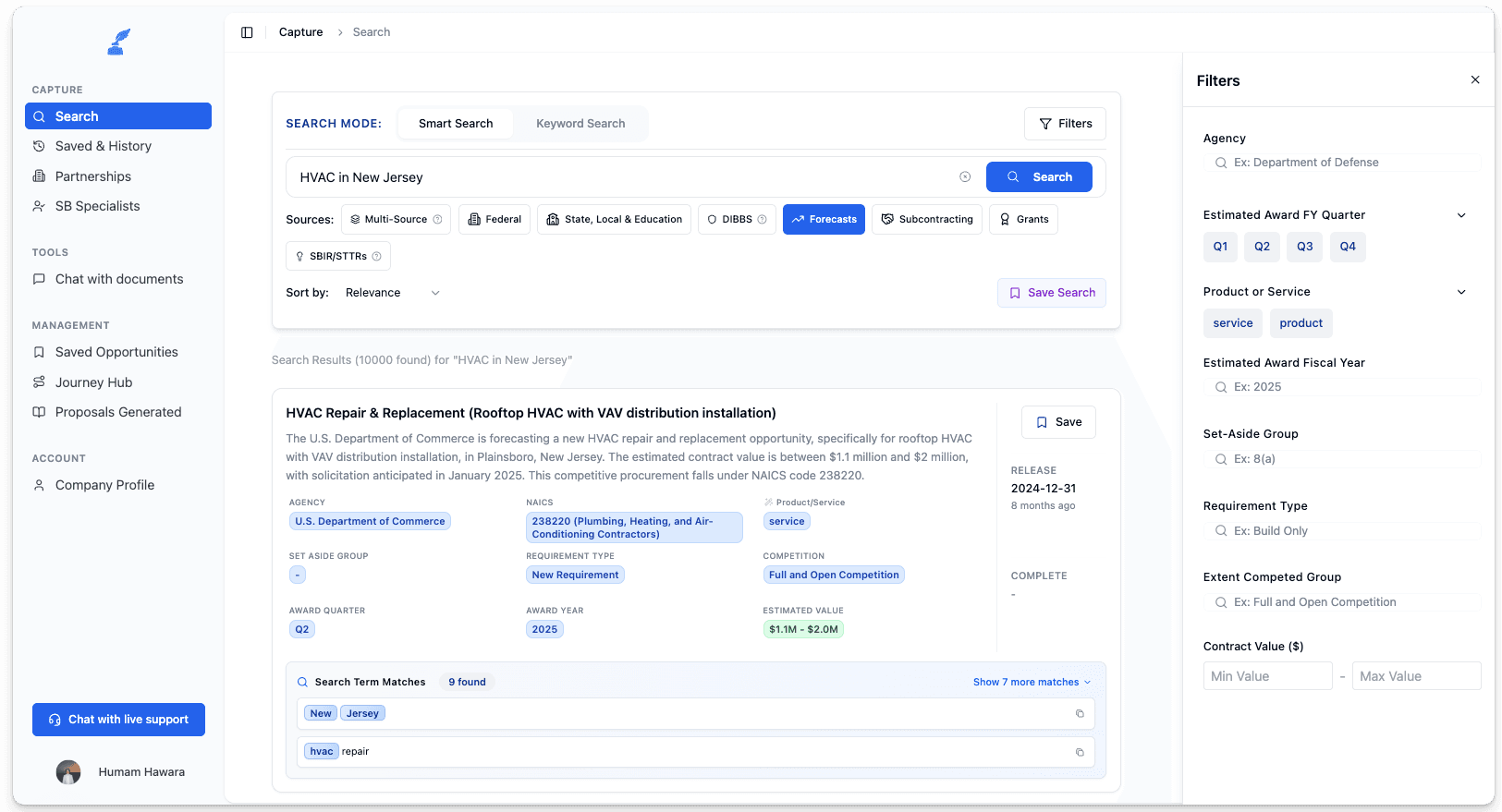

Comprehensive Federal Forecasts

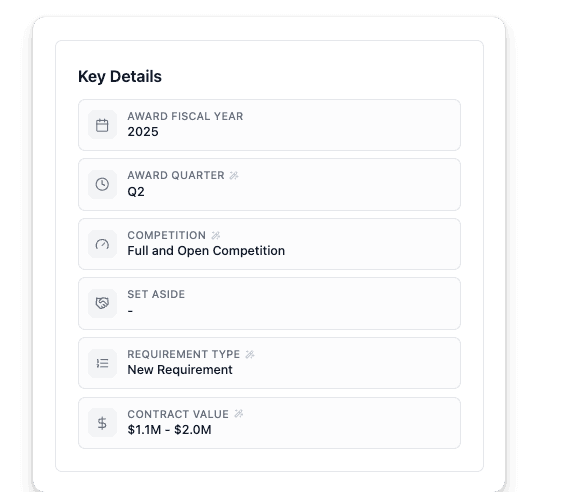

Access forecasts from all federal departments and agencies with detailed contract information including estimated values, scope, and requirements. Stay ahead of opportunities across the entire government landscape.

Access comprehensive federal procurement forecasts with estimated values, release timing, and agency contacts. Win more government contracts with strategic intelligence.

Access forecasts from all federal departments and agencies with detailed contract information including estimated values, scope, and requirements. Stay ahead of opportunities across the entire government landscape.

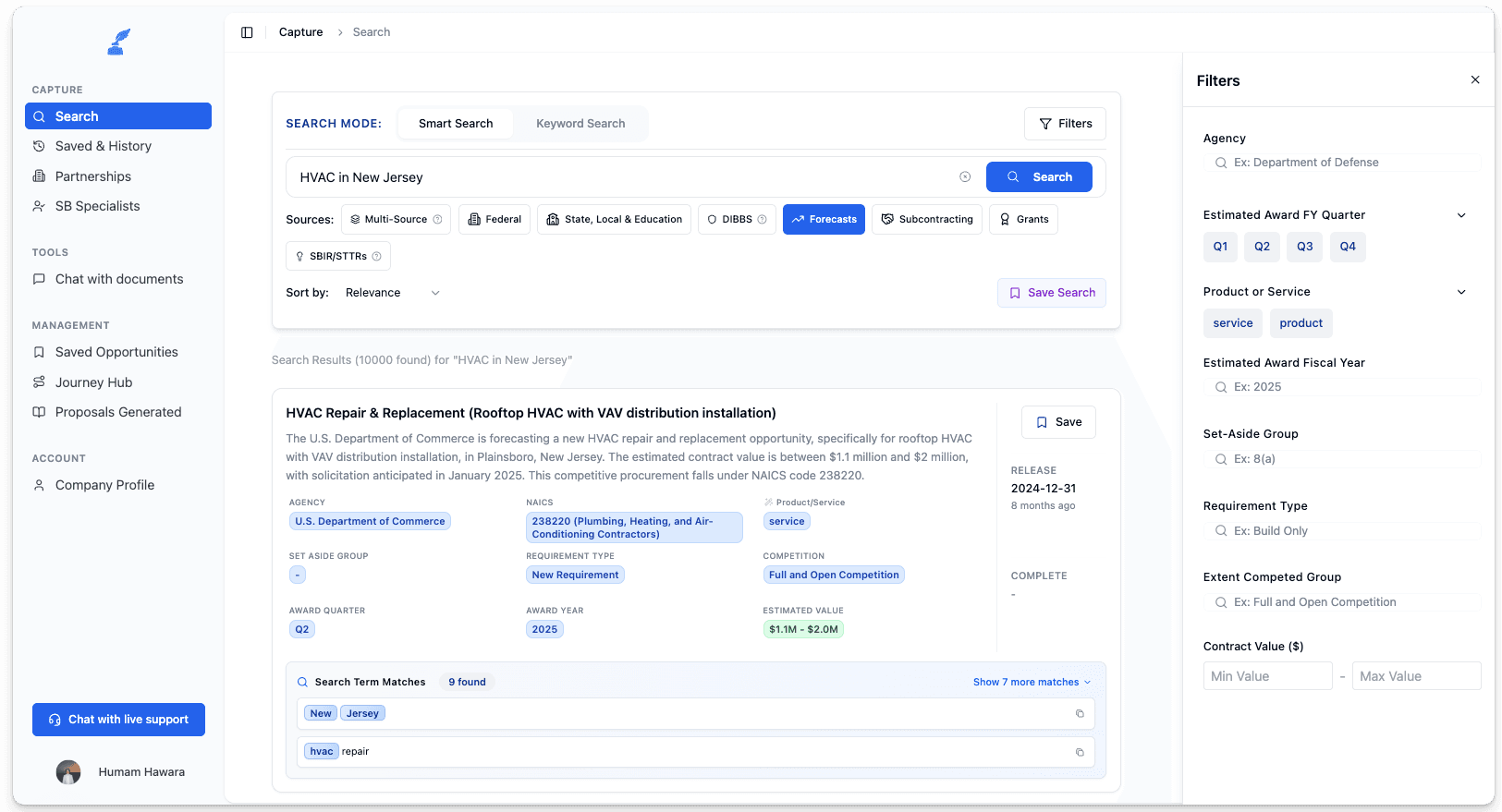

Get precise timing information with quarter and year release schedules. Plan your business development efforts and resource allocation months in advance to position yourself for success.

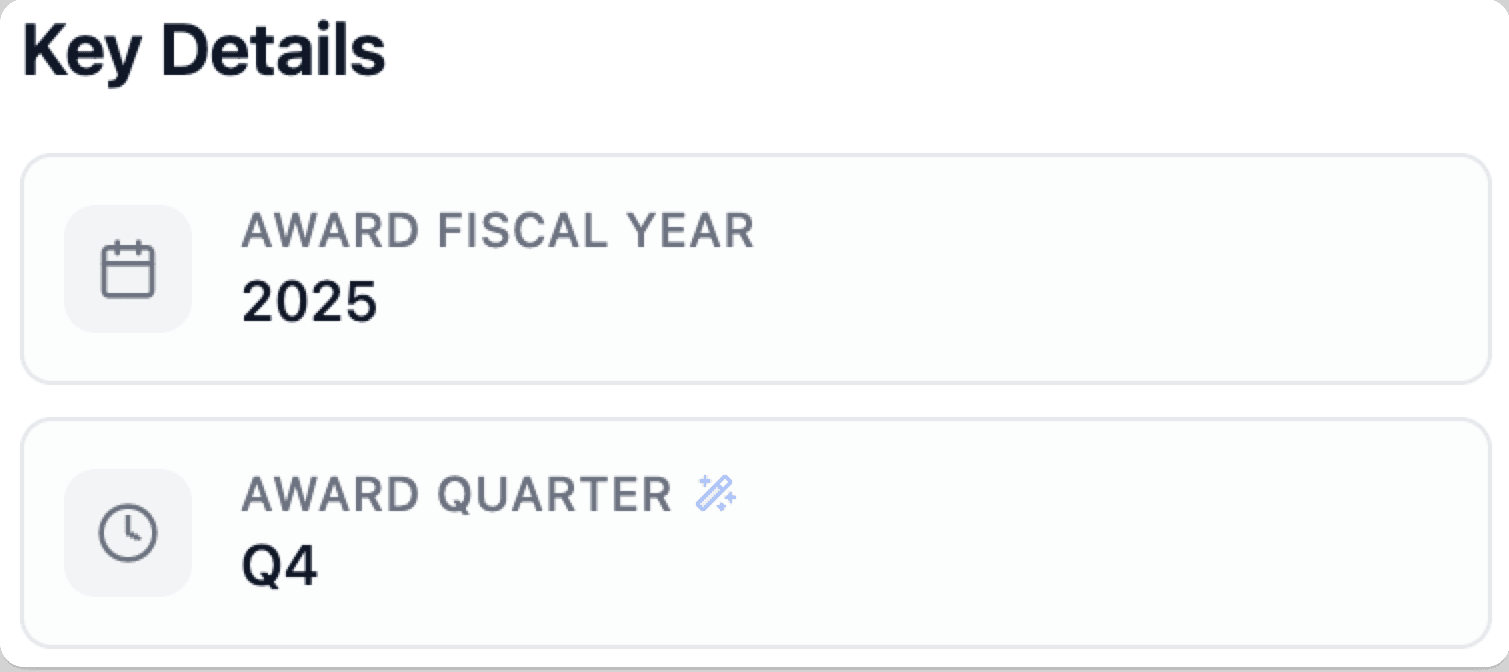

Understand competition types including recompetes, new opportunities, set-asides, and contract vehicles. Know exactly what you're competing for and tailor your approach accordingly.

Get contact information to kickstart conversations with procurement officials and program managers. Build relationships early and gain valuable insights before opportunities are released.

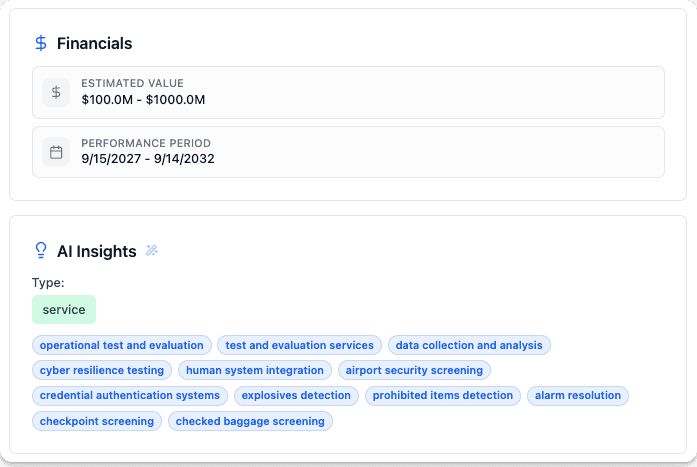

Focus on the most valuable opportunities with detailed estimated contract values. Make strategic decisions about where to invest your proposal resources for maximum ROI.

Get the competitive edge with early intelligence on upcoming federal opportunities

Build relationships with decision makers and position your company before opportunities are released. Strategic planning beats reactive bidding every time.

Know about recompetes and new opportunities before your competitors. Make informed bid/no-bid decisions with early market intelligence.

Focus your proposal budget on winnable opportunities. Reduce costs through better targeting and strategic resource allocation.

Influence requirement development through early engagement. Establish thought leadership and build incumbent relationships for future success.

We gather procurement forecasts from all federal departments and agencies across government.

Access estimated contract values, release timing by quarter and year, and competition types.

Get procurement official contact information to begin relationship building and market research.

Focus on the most valuable and winnable opportunities for your business.

Get ahead of the competition with comprehensive federal procurement forecasts. Access estimated values, timing, and agency contacts to win more government contracts.

Book DemoFederal procurement forecasts are advance notifications of upcoming contract opportunities from government agencies. They include estimated contract values, expected release timing by quarter and year, competition types (recompete, new opportunities, set-asides), and agency contact information to help contractors plan their business development strategies months in advance.

SamSearch aggregates procurement forecasts from all major federal departments and agencies including Department of Defense (DOD), Department of Homeland Security (DHS), General Services Administration (GSA), Department of Veterans Affairs (VA), Health and Human Services (HHS), Department of Energy (DOE), NASA, Department of Transportation (DOT), and many others across the entire federal government landscape.

The contract value estimates are based on agency budget allocations, historical spending patterns, and planned procurement activities. While they provide valuable planning guidance for business development, actual contract values may vary based on final requirements, budget adjustments, and congressional appropriations.

Procurement forecasts include detailed competition type intelligence such as recompete opportunities, brand new contract opportunities, small business set-asides (8(a), HUBZone, WOSB, SDVOSB), unrestricted full and open competition, and specific contract vehicles like GSA Schedules, CIO-SP3, OASIS, and agency-specific IDIQ contracts.

Procurement forecasts enable strategic business development by allowing contractors to plan activities months in advance, allocate BD resources to highest-value opportunities, build relationships with key decision makers early, position companies as go-to solution providers, and influence requirement development through early agency engagement before RFPs are released.

Procurement forecasts include direct contact information for procurement officials, program managers, contracting officers, and other key personnel involved in upcoming opportunities. This enables early relationship building, market research conversations, and strategic positioning before opportunities are officially released.

Federal procurement forecasts typically provide visibility 6-18 months in advance of contract release, with quarterly and annual timing information. This advance notice allows contractors to prepare proposals, gather resources, build strategic partnerships, and position themselves for success before competition begins.

Procurement forecasts are advance notifications of future contracting plans, while active opportunities are currently released RFPs, RFIs, and solicitations. Forecasts help with strategic planning and early positioning, while active opportunities require immediate proposal response and submission.

Small businesses can leverage procurement forecasts to identify set-aside opportunities (8(a), HUBZone, WOSB, SDVOSB), plan subcontracting strategies with prime contractors, allocate limited BD resources effectively, and build relationships with agency personnel before larger competitors become aware of opportunities.

Procurement forecasts cover all NAICS codes across industries including IT services, professional services, construction, healthcare, cybersecurity, engineering, research and development, logistics, facilities management, training, and specialized government services across civilian and defense sectors.

Join hundreds of government contractors who have transformed their business with SamSearch

"SamSearch has been a lifesaver for me and my business. As a govCon consultant helping small businesses win contracts, this tool is all I need to find the right requirements at every level of government. After experimenting with the product, I've discovered features I didn't even know existed. It's affordable, and it's the best on the market."

Nikki

CEO, TSBA | Ex US Navy and US Air Force

"The platform's ability to provide reminders and updates on contracts I'm interested in is a huge time-saver. It allows me to focus on other aspects of my business without missing out on opportunities."

Bobby Hughes

Business Owner - BH Consulting LLC

"I'm a strategy and growth consultant helping small businesses break into SLED and grow. With 25 years in the AEC industry (BD, marketing, proposals) and APMP certification, I left corporate consulting to start my own firm. This tool is a game changer."

Amanda Cerchiara

Strategy & Growth Consultant

"SamSearch is more advanced than any platform we've used, and we value the exceptional support and close collaboration with the team."

Avi Minkoff

President, BHY Gov Solutions

"Best way to find Government Contracts."

Jonathan Seifert

Director of Partnerships, Easy Llama

"We've increased our bid rate by 40% since using SamSearch. We identified opportunities we would have missed with our previous methods."

Evan Naylor

Enterprise Risk Senior Associate, KPMG

"It's a one-stop shop platform. You can upload docs, keep track of who you've talked to, and give a synopsis of process, all in the journey hub. It makes managing and organizing a breeze without manual data entry. Plus, it lets me bid on more opportunities and keep up with progress effortlessly"

Chris

President, Rags and Rose LLC

"SamSearch helped us find and win a construction contract we would've never seen otherwise. Saved us hours of work! The AI-powered search is incredibly accurate."

K.Sawaf

Amara Construction Inc., Owner

"I've tried other tools, but SamSearch is by far the most intuitive and the easiest to use. It's so much faster than the competition and the interface just makes everything easier to navigate."

Lloyd Ntuk

Land Engineering PLC, Managing Principal

"Excellent Customer Service!! Top Notch!"

Steven Porter

CBS Inc, President

"SamSearch by far the most advanced tool we've seen or used. It's our end-to-end and only procurement service we use."

Cody Knudsen

Co-Founder, Tideline Strategies LLC