The Truth About Middleman Strategy in Government Contracting

🎥 Prefer video? Watch the full breakdown here:

Keywords: middleman strategy, government contracting, subcontracting, FAR 52.219-14, limitations on subcontracting, SBA rules, pass-through schemes, small business contracts, legal subcontracting, SamSearch

Introduction

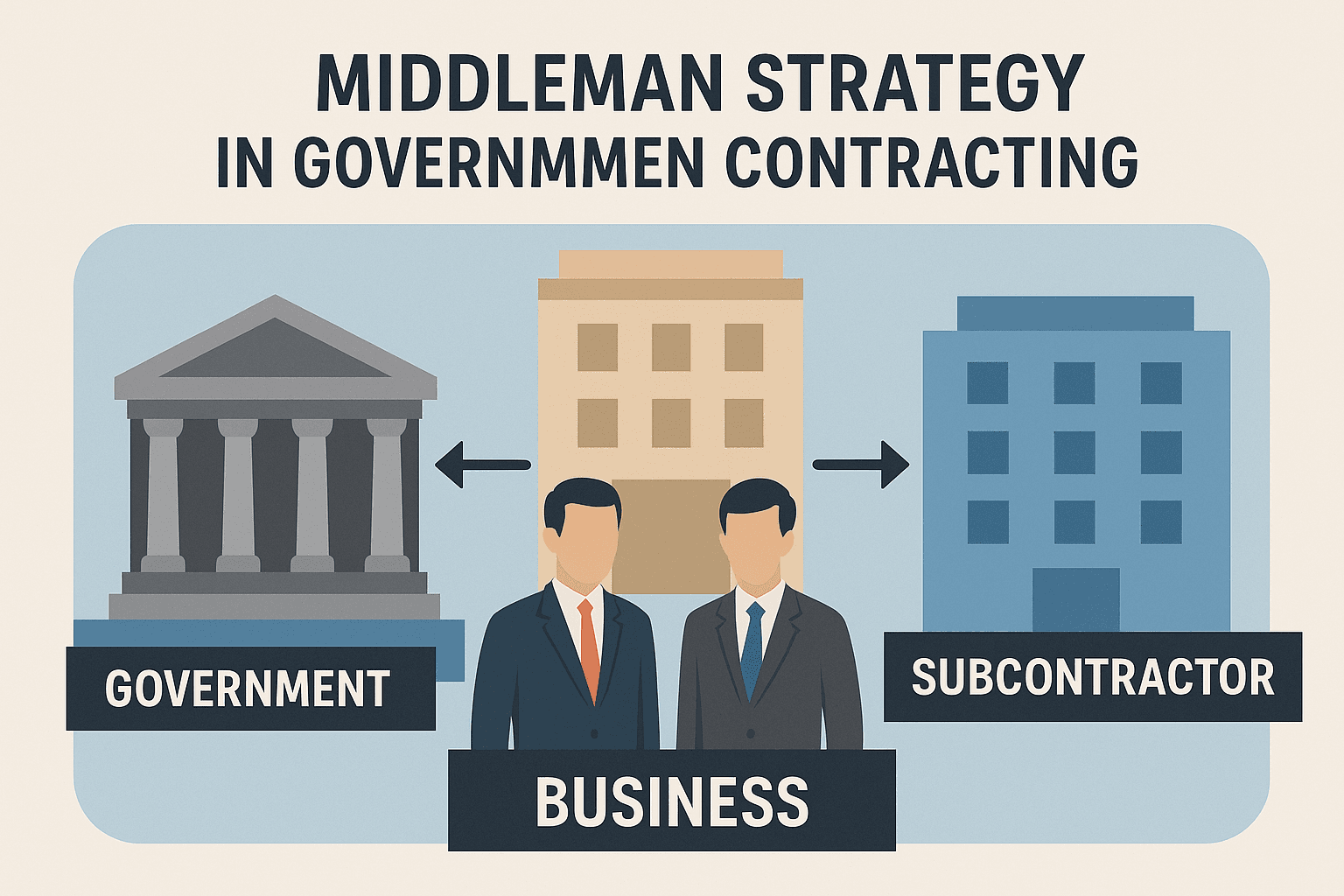

The middleman strategy in government contracting—where a business wins a government contract and outsources work to subcontractors—is both common and often beneficial. However, when not executed correctly, it can cross the line into illegal pass-through schemes that result in criminal penalties, contract termination, and reputational damage.

In this guide, we'll break down:

- What constitutes a legal vs. illegal middleman strategy

- How the Federal Acquisition Regulation (FAR) 52.219-14 and SBA rules define subcontracting limitations

- How to legally and efficiently use subcontractors

- How tools like SamSearch can streamline your compliance and growth

What Is the Middleman Strategy?

At its core, the middleman strategy refers to a prime contractor (you) winning a government contract and using subcontractors to complete some or most of the work.

✅ Legal Scenario You're awarded a contract. You perform the core tasks required by the government. You subcontract remaining specialized or support tasks to qualified companies.

🚫 Illegal Pass-Through You win the contract but subcontract 100% of the work and merely serve as a payment pass-through. You don’t manage the project, perform any substantial labor, or add value.

This illegal practice is often prosecuted as fraud under the False Claims Act and other federal statutes.

Legal Subcontracting: Know the Boundaries

According to FAR 52.219-14, limitations on subcontracting vary based on contract type and are especially critical for small business set-asides over $150,000.

Prime Contractor Work Requirements

| Contract Type | Maximum Subcontracting Allowed to Non-Similarly Situated Entities | |

|---|---|---|

| Services (except construction) | 50% of the amount paid by the Government for contract performance | |

| Supplies (excluding cost of materials) | 50% of the amount paid by the Government for contract performance | |

| General Construction (excluding cost of materials) | 85% of the amount paid by the Government for contract performance | |

| Specialty Trade Construction (excluding cost of materials) | 75% of the amount paid by the Government for contract performance |

These percentages ensure that the prime contractor does meaningful work, rather than acting as a front.

Exceptions to the Rule: “Similarly Situated Entities”

Under SBA guidance, work performed by similarly situated subcontractors counts toward the prime contractor's required work share.

✅ Definition: A similarly situated entity is a first-tier subcontractor that:

- Has the same small business program status as the prime contractor.

- Is considered small under the size standard associated with the NAICS code the prime contractor assigned to the subcontract.(farclause.com)

✅ Example: A woman-owned small business (WOSB) awarded a contract can subcontract work to another WOSB, and that work will count as if performed by the prime.

⚠️ Note: This only applies if the subcontractor has the same socioeconomic designation and the arrangement is clearly documented.

Enforcement: How the Government Detects Pass-Through Schemes

Government agencies take enforcement seriously and use a variety of tools to detect fraud:

- Certified payrolls and project records

- On-site inspections of who is doing the work

- Payment audits tracing fund flows

- Whistleblower complaints from competitors or employees(Arnold & Porter)

Violating subcontracting rules can lead to:

- Contract termination

- Criminal charges

- Fines and repayment of funds

- Suspension or debarment from future contracts

Best Practices for Legal Subcontracting

To stay compliant and profitable, government contractors should follow these core practices:

1. Understand Your Contract Requirements

Don’t assume all contracts have the same thresholds. Check FAR clauses and speak with your contracting officer.

2. Perform Core Work In-House

Ensure you meet or exceed the minimum percentage of work required using your own staff or “similarly situated” partners.

3. Build Real Subcontractor Relationships

Only work with subcontractors who offer real value. Avoid “paper” partnerships or shell companies.

4. Document Everything

Keep audit-ready records that show who performed what work, who got paid, and how much oversight you provided.

5. Use AI Tools to Stay Efficient

Platforms like SamSearch can help you:

- Find pre-qualified subcontractors

- Track and document work shares

- Draft compliant proposals

- Stay organized with built-in project tools

Key Takeaways

✅ The middleman strategy is legal—if done right.

🚫 Illegal pass-throughs can destroy your business.

📘 Follow FAR 52.219-14 and SBA rules to stay compliant.

🧠 Document everything.

⚙️ Use tools like SamSearch to stay competitive and compliant.

Frequently Asked Questions (FAQ)

Q1: What is FAR 52.219-14, and when does it apply?

FAR 52.219-14, titled "Limitations on Subcontracting," applies to small business set-aside contracts. It stipulates the maximum percentage of work that a prime contractor can subcontract to entities that are not "similarly situated." This clause ensures that small businesses perform a significant portion of the contract work themselves.

Q2: How is the subcontracting limitation calculated?

The limitation is based on the amount paid by the government for contract performance, excluding the cost of materials. For example, in a services contract, a prime contractor cannot pay more than 50% of the contract amount to non-similarly situated subcontractors.

Q3: What defines a "similarly situated entity"?

A similarly situated entity is a first-tier subcontractor that shares the same small business program status as the prime contractor and is considered small under the NAICS code assigned to the subcontract. Work performed by such entities counts toward the prime contractor's performance requirements.

Q4: Are there exceptions to these limitations?

Yes. The limitations do not apply to subcontracts performed by similarly situated entities. Additionally, certain contracts may have specific clauses or deviations that alter these requirements. It's essential to review each contract individually and consult with the contracting officer.

Q5: What are the consequences of non-compliance with FAR 52.219-14?

Non-compliance can lead to severe penalties, including contract termination, suspension or debarment from future contracts, financial penalties, and potential legal action for fraud.

Q6: How can I ensure compliance with subcontracting limitations?

To ensure compliance:

- Understand the specific limitations applicable to your contract type.

- Maintain detailed records of work performed and payments made.

- Ensure that any subcontractors meet the criteria for similarly situated entities if applicable.

- Regularly consult with your contracting officer and legal counsel.

Q7: Where can I find more information about governing rules and responsibilities?

The SBA provides comprehensive resources on federal contracting rules and responsibilities. Visit their Governing Rules and Responsibilities page for more information.

Ready to Win More Contracts—Legally?

SamSearch helps businesses find, manage, and win federal contracts the smart way.

🚀 AI-powered opportunity search

About Samsearch

Samsearch is an all-in-one platform that streamlines the entire government contracting process. Our solution brings together discovery, management, compliance, and proposal drafting — eliminating the need for multiple disjointed government contracting softwares.