Beyond SAM.gov: Unlocking the Full Spectrum of Government Opportunities with AI

Beyond SAM.gov: Unlocking the Full Spectrum of Government Opportunities with AI

The System for Award Management (SAM.gov) serves as a central pillar in the federal procurement landscape. It's the official U.S. government website for entities looking to do business with the federal government. For many contractors, it represents the primary, and sometimes only, gateway for discovering federal contract opportunities.

While its role is undeniable, relying solely on SAM.gov presents a significantly incomplete picture of the public sector marketplace.

The 90% Reality Check

Industry analysis consistently reveals that a vast majority of government contract dollars, potentially exceeding 90% when considering the entire public sector ecosystem, are awarded through channels not advertised on SAM.gov. This includes:

-

Substantial federal spending via mechanisms like contract vehicle task orders, sole-source awards, and micropurchases.

-

The enormous, distinct markets of State, Local, and Education (SLED) procurement.

-

Government grants.

-

Specialized research funding programs like the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) initiatives.

Consequences for Contractors

This reality check carries profound consequences for government contractors.

-

Increased Competition: Limiting opportunity discovery to SAM.gov means competing within a potentially smaller, often more crowded, segment of the market.

-

Missed Opportunities: More importantly, it means overlooking vast swathes of less visible, potentially more suitable opportunities distributed across a highly fragmented landscape.

-

Strategic Blind Spots: This limitation extends beyond simply missing individual bids; it creates a fundamental strategic blind spot. Companies relying solely on SAM.gov data develop an incomplete understanding of government spending patterns, agency needs, and competitive dynamics within their specific sectors.

-

Suboptimal Decisions: This skewed market intelligence can lead to suboptimal strategic decisions regarding resource allocation, partnership development, and overall business growth strategy.

Navigating the true, complex, and multifaceted government opportunity landscape requires looking far beyond this single federal portal.

Exploring the Untapped Potential: The Diverse World Beyond SAM.gov

The opportunities missed by focusing only on SAM.gov span multiple domains, each with its own unique characteristics and discovery challenges. Understanding these distinct arenas is the first step toward developing a comprehensive market strategy.

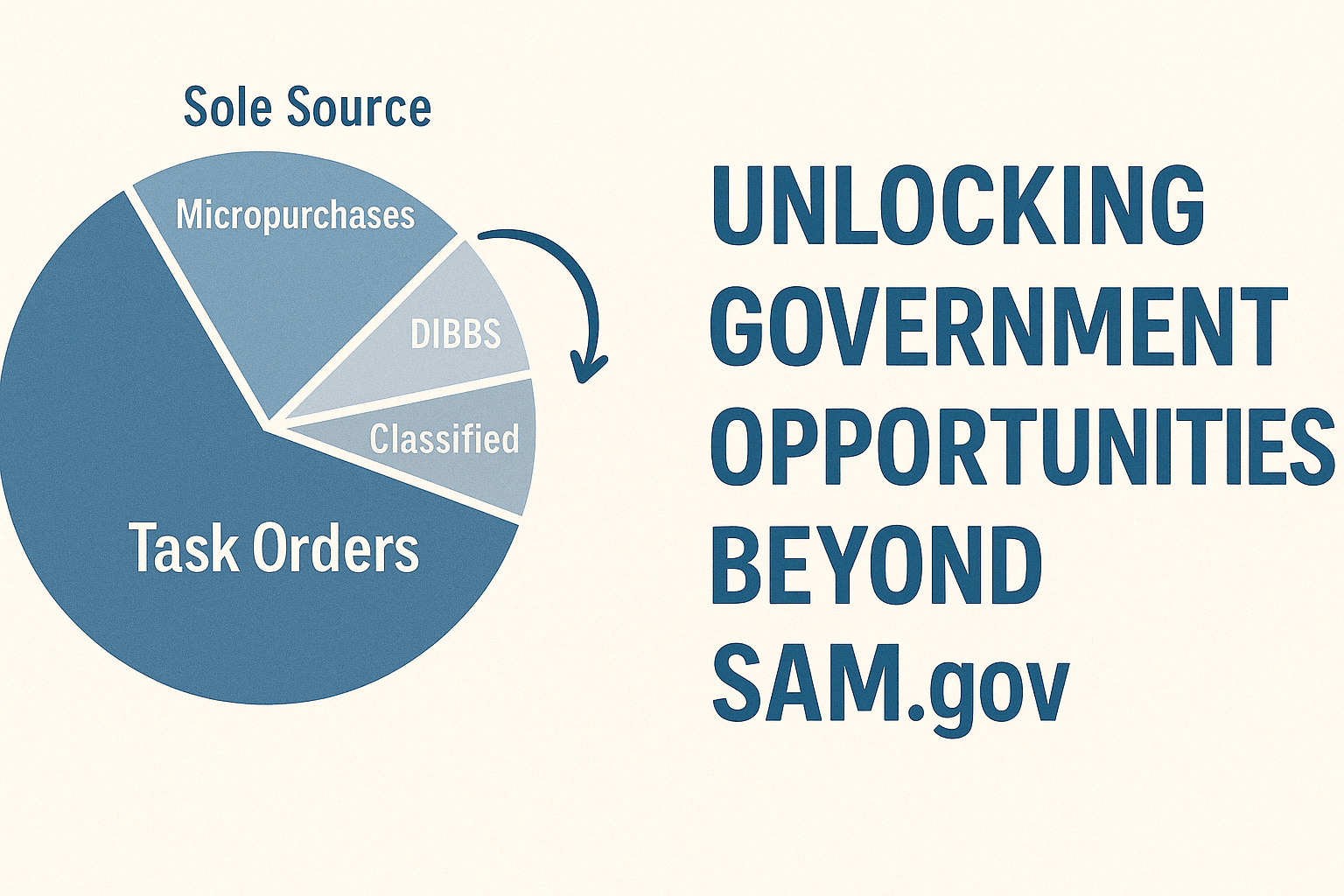

The Federal Arena Beyond SAM.gov

Even within the federal government itself, significant contracting activity occurs outside the public view of SAM.gov. Analysis suggests key categories include :

-

Contract Vehicle Task Orders:

-

Represent a substantial portion of federal award dollars (estimated around 55%).

-

Opportunities are typically solicited through separate portals accessible only to holders of specific Indefinite Delivery/Indefinite Quantity (IDIQ) contracts or Government-Wide Acquisition Contracts (GWACs), such as GSA eBuy or agency-specific systems like Symphony.

-

Solicitations may also be emailed directly to eligible vehicle holders.

-

Access often requires winning a prime spot on the vehicle or establishing teaming partnerships with existing holders.

-

-

Sole Source Contracts:

-

Account for roughly 30% of federal awards.

-

Awarded without a competitive bidding process under specific circumstances (e.g., only one capable source, urgent needs, socioeconomic programs like 8(a), SDVOSB, WOSB).

-

Identifying these requires proactive market intelligence rather than passive solicitation monitoring.

-

-

DIBBS Solicitations:

-

The Defense Logistics Agency (DLA) uses its own DLA Internet Bid Board System (DIBBS) for many sustainment product purchases, particularly those under $25,000.

-

These may not be cross-posted to SAM.gov.

-

Access requires separate registration or integration through specialized platforms.

-

-

Micropurchases:

-

Generally defined as purchases under $10,000.

-

Often utilize Government Purchase Cards (P-Cards) and have significantly reduced acquisition requirements.

-

Typically not posted on SAM.gov due to their low dollar value.

-

-

Niche Acquisition Sites & Restricted Portals:

-

Various federal agencies may use other specialized procurement platforms (like Unison, FedConnect).

-

Restricted portals exist for sensitive procurements, such as the Intelligence Community's Acquisition Research Center (ARC), requiring specific registration and clearance.

-

Proactive Strategies for Non-SAM Federal Opportunities

Successfully pursuing many of these non-SAM federal opportunities necessitates a shift in approach. While finding open solicitations on SAM.gov can be somewhat reactive, capturing sole source awards, influencing micropurchases, or positioning effectively for task orders often depends heavily on proactive business development. This involves:

-

Identifying key agency personnel.

-

Understanding their needs and historical buying patterns (e.g., identifying contracting officers with a history of sole-source awards).

-

Building relationships before a requirement is formally defined.

This relationship imperative highlights the need for robust market intelligence to inform targeted outreach, a different skillset than simply responding to posted bids.

Navigating the SLED Maze: State, Local, and Education Contracts

Beyond the federal government lies the vast and complex market of State, Local, and Education (SLED) procurement. This encompasses state agencies, county governments, city municipalities, K-12 school districts, public universities, and various special districts. The sheer scale is immense, with over 90,000 distinct SLED entities across the United States, each potentially needing goods and services.

The Challenge of Fragmentation

The primary challenge in the SLED market is extreme fragmentation. Unlike the federal government's move towards centralization with SAM.gov, the SLED landscape is characterized by decentralization. Key challenges include :

-

Independent Rules: Each entity typically operates under its own set of procurement rules, regulations, and processes.

-

Disparate Portals: Each often maintains its own purchasing portal or website.

-

No Single Database: There is no single, comprehensive database for all SLED opportunities.

-

Varying Requirements: Contractors face a bewildering array of varying requirements.

-

Unique Jargon: Terminology and jargon can be specific to certain states or localities.

-

Diverse Cycles: Purchasing cycles vary and are difficult to track collectively.

This fragmentation poses challenges not only for vendors seeking opportunities but also for SLED agencies themselves, who sometimes struggle to find and qualify sufficient bidders.

Strategies for SLED Success

Finding and winning SLED contracts typically requires significant manual effort :

-

Identify Targets: Businesses must first identify the specific agencies or entities most likely to purchase their offerings.

-

Research Processes: Research their individual procurement processes via disparate websites.

-

Register Separately: Complete separate registration requirements for numerous portals.

-

Monitor Continuously: Continuously monitor multiple sources for new solicitations.

-

Build Relationships: Relationship-building with SLED procurement officials is also often crucial.

Furthermore, many SLED entities are actively pursuing procurement modernization, implementing new eProcurement systems and automating processes. While aimed at long-term efficiency, this transition period can introduce another layer of complexity. As different entities adopt different systems at different speeds, vendors may find the landscape more fragmented and challenging to navigate in the short-to-medium term, reinforcing the need for aggregation solutions.

Securing Innovation & Program Funding: Grants

Government grants represent another significant funding stream, distinct from procurement contracts. Grants are typically assistance awards, providing financial support for projects and programs aligned with agency missions, rather than purchasing specific goods or services for direct government use.

Beyond Grants.gov

While Grants.gov serves as the primary portal for federal grant opportunities , it is not the only source. Billions in grant funding are available annually, including opportunities for which for-profit companies are eligible. Additionally, a substantial volume of grant funding originates from non-federal sources, including state and local governments, private foundations, and other philanthropic organizations.

Challenges in the Grant Ecosystem

Seeking grant funding presents its own set of hurdles:

-

Portal Navigation: Navigating Grants.gov itself can be challenging, with users potentially encountering technical errors, confusing eligibility requirements, or usability issues.

-

Finding Opportunities: Finding relevant opportunities requires searching across numerous federal agencies (each with unique priorities, e.g., NIH ) and monitoring the disparate landscape of non-federal grantmakers.

-

Application Complexity: Grant applications often involve complex requirements and significant administrative effort, posing a particular burden for smaller or under-resourced organizations.

-

Data Transparency: Oversight bodies like the Government Accountability Office (GAO) have pointed to challenges related to the timeliness, completeness, and accuracy of grant award data reported through federal systems, impacting transparency.

These interconnected difficulties—from portal usability and operational challenges to data transparency issues —create friction for applicants, agencies, and oversight bodies, underscoring the value of tools that can aggregate information and simplify discovery.

Fueling R&D: Small Business Innovation Research (SBIR) & Technology Transfer (STTR)

The SBIR and STTR programs are vital federal initiatives designed to stimulate technological innovation by funding research and development (R&D) at small businesses.

Program Structure and Goals

-

Goal: Meet federal R&D needs while fostering commercialization of resulting technologies.

-

Phased Structure:

-

Phase I: Feasibility.

-

Phase II: Further R&D and prototype development.

-

Phase III: Commercialization (typically requires non-SBIR/STTR funding).

-

-

STTR Distinction: Mandates collaboration between the small business and a non-profit research institution (e.g., university, FFRDC).

-

Participation: Currently, 11 federal agencies participate in SBIR, and 5-6 participate in STTR.

Navigating SBIR/STTR Hurdles

Despite their importance, navigating the SBIR and STTR programs involves significant hurdles:

-

Strict Eligibility: Requirements are strict and specific to these programs.

-

Complex Processes: Application and registration processes can be complex, requiring registrations across multiple systems (e.g., SBIR.gov, SAM.gov, agency-specific portals like DSIP for DoD).

-

Funding Gap ("Valley of Death"): A major challenge is the funding gap often encountered between Phase II completion and securing Phase III or commercial sales.

-

Finding Partners: Finding suitable partners (research institutions for STTR, prime contractors for transition) can be difficult.

-

Multi-Agency Monitoring: Small businesses must monitor solicitations across multiple participating agencies, each with its own R&D priorities and timelines.

-

IP and Fraud Concerns: Concerns about intellectual property protection and significant fraud risks, highlighted by GAO reports , add complexity.

-

Data Quality Issues: GAO has noted data quality issues within the central SBIR.gov portal, potentially hindering effective program oversight.

Achieving success in SBIR/STTR demands sophisticated navigation of a complex ecosystem involving specific agency missions, strategic partnerships, securing follow-on funding, and managing programmatic risks.

The High Cost of Fragmented Search: Time, Resources, and Missed Opportunities

The exploration across Federal (beyond SAM.gov), SLED, Grants, and SBIR/STTR reveals a stark reality: the public sector opportunity landscape is vast, diverse, and highly fragmented.

The Drain on Time and Resources

Attempting to monitor this landscape comprehensively using manual methods—visiting dozens or even hundreds of individual websites, agency portals, and third-party databases—imposes significant costs:

-

Time Consuming: Business development teams spend countless hours manually searching, filtering irrelevant results, tracking deadlines, and synthesizing information.

-

Inefficient & Error-Prone: This manual effort is inefficient and prone to error. Relevant opportunities are easily missed due to incomplete coverage or oversight.

-

Difficult Navigation: Managing multiple logins, understanding idiosyncratic search functionalities, and navigating unique jargon (especially SLED ) adds difficulty.

Complexity Across Streams

This fragmentation makes it nearly impossible to gain a holistic, real-time view of the market, hindering effective strategic planning. The challenge isn't merely additive; tracking each additional opportunity stream increases complexity exponentially. Learning new systems, procurement rules , and terminology requires dedicated effort, raising the cognitive load and the probability of missing critical information.

The table below summarizes the key challenges across these diverse opportunity streams:

**Opportunity TypeTypical SourcesKey Discovery ChallengesHow SamSearch.co Helps (Brief)Federal (Beyond SAM.gov)Agency Portals (e.g., eBuy, DIBBS), Email, Restricted Sites (e.g., ARC), DirectLimited Visibility, Restricted Access, Relationship-Dependent (Sole Source/Micro), Niche Portals, Separate Registrations Aggregates accessible federal data, AI identifies relevant oppsSLED (State, Local, Education)90,000+ Individual Entity Websites/Portals, State Procurement SitesExtreme Fragmentation, Independent Rules/Processes, Varying Jargon/Cycles, Multiple Registrations, Modernization Complexity Unified SLED search across thousands of sourcesGrants (Federal & Non-Federal)**Grants.gov, Agency Sites (e.g., NIH), Foundation Databases, State/Local SitesPortal Usability/Errors, Eligibility Complexity, Non-Federal Source Tracking, Administrative Burden, Data Transparency Issues Centralized Grant search (Federal & potentially others)**SBIR/STTR (Small Business R&D Funding)**SBIR.gov, Agency-Specific Solicitations (e.g., DoD DSIP)Eligibility Rules, Complex Applications, Multi-Agency Navigation, Partnership Needs, Funding Gaps ("Valley of Death"), Fraud Risks Consolidated SBIR/STTR opportunity discovery

Introducing SamSearch.co: Your Centralized AI-Powered Opportunity Hub

Addressing the inefficiency and risk of fragmented searches requires a modern, intelligent approach. SamSearch.co emerges as a comprehensive solution designed to consolidate the vast public sector marketplace into a single, streamlined platform.

Comprehensive Coverage

SamSearch.co provides extensive coverage, aggregating opportunities across the full spectrum:

-

Federal contracts (including sources beyond SAM.gov)

-

The complex SLED market

-

Diverse Grant programs

-

Specialized SBIR/STTR funding initiatives

This unification eliminates the need to monitor countless disparate sources.

The Power of AI

At the core of the platform lies powerful Artificial Intelligence (AI). SamSearch.co leverages AI to revolutionize discovery:

-

Plain Language Search: Users employ plain language queries, moving beyond complex Boolean operators.

-

Intelligent Filtering: The AI interprets user intent and business profiles to deliver highly relevant opportunities, filtering out noise.

-

Complexity Absorption: AI intelligently processes unstructured and inconsistent data from thousands of sources, translating chaos into a standardized, actionable user experience. The platform shields users from market fragmentation.

Gain Your Competitive Edge: Benefits of Using SamSearch.co

Leveraging SamSearch.co translates into tangible competitive advantages, enabling faster, smarter decisions and more efficient workflows.

-

Maximize Efficiency & Save Time:

-

Drastically reduces time spent on discovery.

-

AI-generated summaries provide concise overviews for rapid assessment.

-

AI attachment summarizer extracts key information from lengthy documents.

-

Frees up business development resources for higher-value activities.

-

-

Uncover Every Relevant Opportunity:

-

Comprehensive coverage (Federal, SLED, Grants, SBIR/STTR) ensures visibility.

-

Testimonials indicate users find contracts missed by previous methods.

-

Timely, customized email notifications provide a speed advantage.

-

-

Make Faster, Smarter Bid Decisions:

-

AI Opportunity Chat allows users to ask specific questions about opportunities.

-

Instant Opportunity Insights provide context (similar past opps, incumbents, potential subs) for competitive intelligence.

-

-

Streamline Proposal Efforts:

-

AI proposal generation capabilities assist development.

-

AI text editor helps draft personalized content.

-

AI chat assistant supercharges proposal writing.

-

Improves proposal quality and potentially increases win rates.

-

By automating labor-intensive tasks, SamSearch.co shifts how resources are utilized. Instead of data collection, teams can focus on strategic analysis, relationship building (addressing the 'Relationship Imperative'), crafting compelling proposals, and refining win strategies. This strategic reallocation contributes directly to higher win probabilities and business growth.

Conclusion: Stop Searching, Start Winning

The government contracting landscape extends far beyond SAM.gov. To capitalize on the full spectrum of public sector opportunities, contractors must embrace the diverse worlds of federal task orders, sole-source contracts, micropurchases, SLED procurement, grants, and SBIR/STTR funding.

Attempting to navigate this fragmented ecosystem manually is inefficient, resource-intensive, and risks missing critical opportunities. SamSearch.co provides the essential modern toolkit. Leveraging AI, it offers comprehensive coverage, consolidates opportunities, saves time, surfaces hard-to-find leads, and delivers procurement intelligence for faster, informed decisions.

In today's competitive market, advanced technology is crucial. Platforms like SamSearch.co empower contractors to move beyond traditional search methods, focus on strategic pursuits, and ultimately, win more business.

What to do now?

Stop missing out on the vast majority of government opportunities. Discover the power of comprehensive, AI-driven opportunity discovery with SamSearch.co.

-

Visit SamSearch.co to learn how AI can transform your government contracting efforts.

-

Explore the advanced AI-powered search features covering Federal, SLED, Grants, and SBIR/STTR opportunities.

-

Request a personalized demonstration or sign up for a trial today to experience the benefits firsthand.