The Subcontractor's Playbook: How to Find and Win Lucrative Opportunities in 2025

The Subcontractor's Playbook: How to Find and Win Lucrative Opportunities in 2025

The Uphill Battle: Why Finding Great Subcontracting Work is Harder Than Ever

In the current economic landscape, subcontractors face a significant paradox. On one hand, historic investments in infrastructure promise a surge in government contracting opportunities for a wide range of sectors.[1] On the other hand, this influx of potential work has intensified competition, particularly from larger, well-established firms that small businesses struggle to compete against.[2] The reality for today's subcontractor is that technical excellence in a trade is no longer sufficient for success. Thriving in 2025 and beyond requires mastering the complex and often grueling business of finding, vetting, and winning the right opportunities. This initial phase of the project lifecycle has become an uphill battle, defined by a gauntlet of persistent and interconnected challenges.

The Gauntlet of Challenges

The path to securing profitable subcontracting work is fraught with obstacles that disproportionately affect small and growing businesses. These challenges create a high barrier to entry and can stifle growth even for the most skilled tradespeople.

- Resource Scarcity: A primary hurdle is the lack of resources and specialized expertise. Many small enterprises do not have dedicated teams or sufficient knowledge to navigate the intricate processes of bidding, ensuring compliance, and managing contracts. This operational deficit places them at a significant disadvantage when competing against larger organizations with entire departments devoted to these functions.[2, 3]

- Financial Strain: The construction and government contracting industries are notorious for long and often unpredictable payment cycles.[4, 5] Subcontractors can wait over 60 days for payment on a completed job, creating severe cash flow constraints. This financial pressure makes it difficult to cover upfront material and labor costs for new projects, forcing businesses to hesitate or decline opportunities they are otherwise qualified for, thereby limiting their growth potential.[3]

- The "Who You Know" Barrier: Despite the formalization of procurement, both private and public sectors remain deeply relationship-driven. Many prime contractors prefer to award jobs to subcontractors they know and have worked with before, viewing it as a way to ensure reliability and quality.[6] This creates a closed loop that is incredibly difficult for new or lesser-known firms to penetrate. The sentiment among many newcomers is that it takes 18 months to three years of persistent effort just to gain traction and build the necessary relationships to win consistently.[7]

- Regulatory Overload: The world of contracting, especially in the federal space, is a labyrinth of complex rules and regulations. Subcontractors must contend with the Federal Acquisition Regulation (FAR), Small Business Administration (SBA) size standards, and ever-changing government mandates.[5, 8, 9] Compliance is non-negotiable, and failure to adhere to these standards can result in disqualification, financial penalties, or even debarment from future contracts. For small businesses without legal or compliance experts, this regulatory burden is both intimidating and time-consuming.[1, 10]

- The Long and Winding Road to a "Yes": Government procurement cycles are notoriously lengthy and can be unpredictable.[2] It is not uncommon for the process from bid submission to contract award to take several months, and sometimes even years. This extended timeline requires immense patience and persistence, a luxury many small businesses struggling with cash flow cannot afford. The constant rejection or lack of response during this long waiting period can be demoralizing and lead many to question the viability of pursuing these contracts.[7, 11]

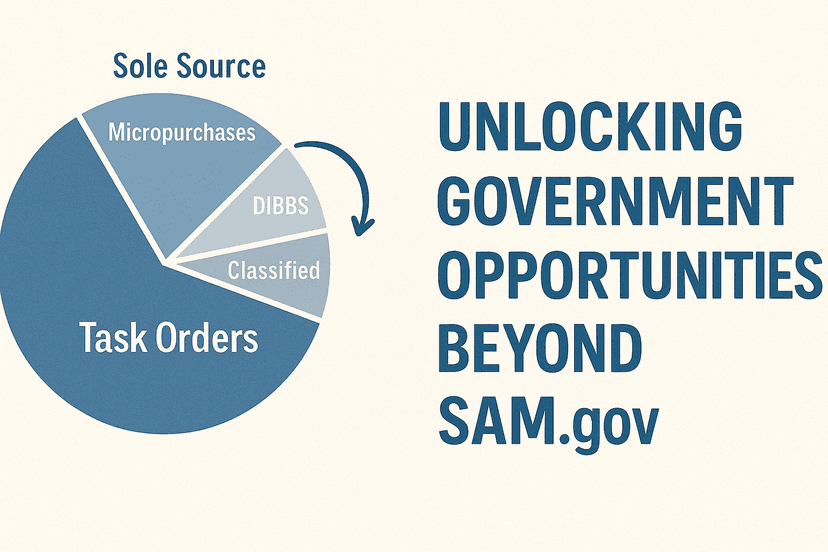

The core difficulty, however, is not any single one of these challenges, but their cumulative and fragmented nature. To maximize opportunities, a subcontractor is expected to simultaneously monitor dozens of disparate channels. This includes federal portals like SAM.gov, agency-specific directories, and the SBA's SUBNet database.[9, 12, 13] Concurrently, they must subscribe to and track multiple private bidding platforms, each with its own interface and cost.[14, 15] Added to this is the necessity of attending in-person networking events to build those crucial relationships.[16, 17] This multi-front effort creates a massive and unsustainable administrative burden. For a small business already hampered by a lack of resources, this operational chaos pulls focus and energy away from their core competency: delivering high-quality work. The fundamental problem is the absence of a single, efficient system to manage this fragmented and demanding opportunity ecosystem.

Value Part 1: Building Your Foundation - The Analog Advantage in a Digital World

In an era dominated by digital platforms and automated alerts, it can be tempting to believe that success is just a click away. However, the most resilient and successful subcontracting businesses understand that technology is a tool to enhance, not replace, the timeless power of human connection. The construction and government contracting sectors remain deeply relationship-driven industries.[7, 17] Building a solid foundation through traditional, "analog" methods is not an outdated practice; it is a critical strategy for long-term growth and stability.

Mastering the Art of the Handshake: High-Impact Networking

The objective of networking is to transition from being an unknown name on a bid sheet to a trusted, go-to partner. This requires a strategic and persistent approach to building genuine professional relationships.

- Strategic Presence at Industry Events & Trade Shows: Attending events hosted by local Chambers of Commerce or major industry associations is a fundamental tactic. The goal extends beyond simply collecting business cards. It involves engaging in meaningful conversations with prime contractors and other decision-makers.[16, 18] A successful interaction hinges on articulating a clear value proposition. Instead of merely asking for work, a subcontractor should be prepared to explain precisely how their services solve a prime contractor's specific problems, such as meeting deadlines, adhering to safety standards, or bringing specialized expertise to a project.[17]

- Leveraging Industry Days: Government agencies and the prime contractors pursuing their work frequently host "Industry Days" before a formal solicitation is released. These events are invaluable sources of intelligence. They provide insights into an agency's specific needs and challenges, and, most importantly, they offer a direct line of sight to the key players who will be bidding on the work. Attendee lists are often published on SAM.gov and can be used as a targeted outreach list to connect with potential partners before a bid is even submitted.[17, 19]

- Local Job Site Reconnaissance: For subcontractors in the construction trades, one of the most effective and direct methods of networking is visiting local job sites. By observing projects in progress, one can identify the general contractors and other trades active in the area. A professional, non-disruptive introduction to a site supervisor can open doors and create connections that would be impossible to forge online. This demonstrates initiative and a tangible connection to the local market.[20, 21]

The Power of Association: Leveraging Industry Groups for Credibility and Connections

Joining professional associations should be viewed not as an expense, but as a strategic investment in credibility, continuous education, and high-level networking. Active participation signals a commitment to the industry and provides unparalleled access to potential partners.

- American Subcontractors Association (ASA): This organization is dedicated to promoting the rights and interests of subcontractors. Membership provides access to educational resources, contract negotiation tips, and networking events tailored specifically to the needs of subcontractors.[22]

- Associated General Contractors of America (AGC): While seemingly for GCs, joining an association like the AGC provides subcontractors with direct and regular access to the very decision-makers they need to build relationships with. It offers a platform to understand the challenges and priorities of general contractors from their perspective.[23]

- Associated Builders and Contractors (ABC): With a large national footprint, ABC represents a broad swath of the construction industry. It offers significant networking opportunities and resources for members based on the merit shop philosophy.[24]

- Niche and Identity-Focused Associations: Beyond the major organizations, trade-specific groups (e.g., National Electrical Contractors Association) and identity-focused associations (e.g., National Association of Women in Construction, National Association of Minority Contractors) provide highly targeted networking and advocacy, helping businesses connect with primes seeking to fulfill specific supplier diversity goals.[25, 26]

Becoming the Go-To Expert: Your Reputation as Your Best Marketing Tool

The ultimate strategic goal for any subcontractor is to build a reputation so strong that work begins to find them through referrals. This is achieved through consistent, high-quality performance that generates powerful word-of-mouth marketing.

- Cultivating a Network of Peers: Fellow subcontractors should be viewed as colleagues, not just competitors. They can be a vital source of overflow work when their schedules are full or can recommend a trusted peer for a job that falls outside their specialty. Building these reciprocal relationships creates a resilient support system.[6]

- Documenting Excellence: A professional portfolio is non-negotiable. It should be meticulously maintained with high-quality photographs, detailed project descriptions, and clear outcomes. This portfolio serves as tangible, compelling evidence of a subcontractor's capabilities and quality standards.[6]

- Actively Soliciting Testimonials and References: Prime contractors perform due diligence before hiring a new subcontractor.[27, 28] Instead of waiting for a client to offer a testimonial, successful subcontractors make it a standard part of their project close-out process to request a review or permission to be listed as a reference. This proactive approach builds a repository of social proof that is crucial for winning the trust of new partners.

Subcontractors often perceive these traditional networking activities through the lens of sales. However, this viewpoint misses the prime contractor's critical perspective. For a prime, hiring an unknown subcontractor is a significant liability. The project's success hinges on the performance of its subs, and a failure by one can lead to cascading delays, cost overruns, and damage to the prime's reputation.[29] The challenges primes face with subcontractors are extensive, ranging from inconsistent work quality and poor communication to serious safety violations and payment disputes.[4, 30, 31] Consequently, their vetting process is rigorous, often involving checks on safety records, financial stability, and extensive reference calls.[27, 29]

This is where the true value of analog networking lies. It functions as a long-term risk mitigation strategy for the prime contractor. A subcontractor who is consistently visible at AGC meetings, who is known and respected by peers, and who has built a reputation for reliability over time is perceived as a much lower risk than an unfamiliar name attached to a digital bid. These traditional methods allow a subcontractor to build trust and demonstrate dependability in a way that a proposal alone cannot. The goal of this "analog advantage" is not simply to sell services, but to prove that one's business is a safe and reliable choice.

Value Part 2: The Digital Playbook - Dominating the Online Search for Contracts

While a foundation of personal relationships is irreplaceable, scaling a subcontracting business in 2025 requires a sophisticated and proactive digital strategy. The online ecosystem is vast and complex, but mastering its key platforms can unlock a steady stream of opportunities that would be impossible to find through analog methods alone. This section provides a practical, step-by-step guide to navigating the digital landscape, from deciphering government portals to building a compelling online brand.

Decoding Government Portals: Your Step-by-Step Guide to the Federal Marketplace

For businesses seeking to work on federally funded projects, a handful of government-run websites are the official and indispensable starting points. Understanding how to leverage these tools is a prerequisite for entry into this lucrative market.

- The Foundation: System for Award Management (SAM.gov): This is the single, official point of entry for any business wanting to work with the U.S. federal government.[12, 32] Registration is mandatory. Beyond registration, its "Contract Opportunities" search function is the primary tool for finding work. A subcontractor should become proficient in using its advanced filters to search for prime contract opportunities by North American Industry Classification System (NAICS) codes, small business set-asides (such as Woman-Owned Small Business or HUBZone), and place of performance.[9, 33] A key feature for subcontractors is the "Interested Vendors List" on each opportunity, which reveals which prime contractors are tracking a specific project, providing a ready-made list for targeted outreach.[34]

- Finding Primes with Mandates: SBA and GSA Directories: Federal law requires that large contracts awarded to "other than small" businesses include a small business subcontracting plan. This mandate means that large prime contractors are legally obligated to award a percentage of their contract value to various categories of small businesses.[12] This creates a powerful leverage point.

- SBA's Directory of Federal Government Prime Contractors with a Subcontracting Plan: The SBA provides a downloadable spreadsheet listing all prime contractors with such plans.[35] This directory is a goldmine, allowing small businesses to create a highly targeted list of large companies that are actively and legally required to seek them out.[35]

- GSA Subcontracting Directory: The General Services Administration (GSA) maintains its own directory of prime contractors who hold GSA Schedule contracts and have subcontracting plans. This is an essential resource for businesses whose services fall under GSA's vast offerings.[13]

- The Hidden Gem: SBA's SUBNet: While SAM.gov lists prime contract opportunities, the SBA's Subcontracting Network (SUBNet) is a reverse marketplace. Here, prime contractors post specific subcontracting opportunities directly for small businesses to view and bid on.[12, 36] It is one of the most direct and efficient paths to securing a subcontracting role in the federal space.[12, 37]

- Agency-Specific Resources and Expert Help: Major federal agencies, such as the Department of Defense (DoD) and the Department of Transportation (DOT), often maintain their own portals and directories of their prime contractors, offering another layer of research for specialized firms.[37, 38] Navigating this complex web of sites can be daunting. For this reason, subcontractors should seek out their local APEX Accelerator (formerly known as a Procurement Technical Assistance Center or PTAC). These government-funded centers provide free, one-on-one expert counseling to help businesses navigate the federal procurement process from start to finish.[12, 39]

The Rise of Digital Marketplaces: Choosing Your Platform Wisely

Parallel to the government's ecosystem, the private sector—especially in construction—has a thriving landscape of digital bidding platforms that connect general contractors (GCs) with subcontractors. Subscribing to the right service can provide a significant competitive advantage, but choosing wisely is key.

- Platform Deep Dive: Several major players dominate the market, each with a slightly different focus.

- ConstructConnect: This platform, which includes the legacy iSqFt network, is a powerhouse known for its vast database of public and private commercial projects and its integrated digital takeoff and estimating tools.[40, 41]

- Dodge Construction Network: A long-standing leader in the industry, Dodge is prized for its comprehensive project data, analytics, and ability to provide intelligence on projects in their earliest planning stages, giving subcontractors a head start.[14, 15]

- PlanHub: Often praised for its user-friendly interface and strong focus on the subcontractor experience, PlanHub offers a robust set of tools for finding projects and managing bids.[14, 42]

- BuildingConnected: As part of the Autodesk family of construction software, this platform has become an industry standard for bid management. Many GCs use it exclusively to invite and manage bids from their network of subcontractors, making a presence on the platform essential in many markets.[14]

To aid in the decision-making process, the following table compares the leading platforms on the criteria most important to subcontractors.

| Platform | Primary Focus | Network Size | Key Differentiator/Feature | Pricing Model |

|---|---|---|---|---|

| ConstructConnect | Commercial (Public & Private) | Very Large (North America) | Deep project data, integrated takeoff tools (PlanSwift) | Subscription |

| Dodge Construction Network | Commercial, Institutional | Very Large | Early-stage project leads, market analytics | Subscription |

| PlanHub | Commercial (Subcontractor-focused) | Large (Nationwide US) | User-friendly bid management, strong GC directory | Freemium/Subscription |

| BuildingConnected | Commercial (Bid Management) | Very Large (Industry Standard) | Bid Board Pro for subs, strong GC adoption | Freemium/Subscription |

| GovernmentBids / BidNet Direct | Public Sector / Government | Large (US agencies) | Aggregates government RFPs, personalized alerts | Subscription |

Your Digital Storefront: Building a LinkedIn Profile That Wins Contracts

In the B2B world, LinkedIn is far more than an online resume. It is a dynamic platform for professional branding, targeted networking, and establishing thought leadership.[43] Prime contractors and GCs routinely use LinkedIn to vet potential partners, making a polished and professional presence a critical business asset.

- Optimize Your Profile for Search: A subcontractor's profile must be built to be found. This starts with a professional headshot and a keyword-rich headline that clearly states their specialty and value proposition (e.g., "Commercial HVAC Subcontractor | Specializing in Federal and Healthcare Projects").[43, 44] The "About" section should not be a list of duties but a compelling narrative that explains the problems the company solves for its clients.

- Show, Don't Just Tell: The "Featured" section of a LinkedIn profile is prime real estate for showcasing a portfolio. High-quality photos of completed projects, links to case studies, and client testimonials provide tangible proof of capabilities. For construction trades, before-and-after photos are an especially powerful and visually engaging way to demonstrate expertise.[43, 45]

- Strategic Connecting: LinkedIn's powerful search function allows subcontractors to identify and connect directly with key decision-makers at their target companies, such as Project Managers, Estimators, and Small Business Liaison Officers (SBLOs).[44, 46] Every connection request should be personalized with a brief message explaining the reason for connecting.

- Engage and Educate: A passive profile is an invisible profile. To build visibility and establish credibility, subcontractors must actively engage on the platform. This includes sharing project updates, posting insights on industry trends, and participating thoughtfully in discussions initiated by prime contractors and industry associations. This consistent activity keeps a company top-of-mind and positions it as an expert in its field.[43, 47]

Beyond the Bid: Essential SEO for Subcontractors

Search Engine Optimization (SEO) is the process of making a business visible when a potential client uses a search engine like Google. For subcontractors, the goal of SEO is straightforward: to appear at the top of the results when a prime contractor or GC searches for a specific trade in a specific geographic area.

- Claim Your Google Business Profile: This is the single most important action a subcontractor can take for local SEO. A complete and optimized Google Business Profile, which is free, ensures a business appears in local map results. It is crucial that the Name, Address, and Phone number (NAP) are accurate and consistent across the web. Actively encouraging satisfied clients to leave reviews on this profile builds social proof and signals to Google that the business is active and reputable.[48, 49]

- Target Long-Tail Keywords: Competing for broad, generic keywords like "construction" or "contractor" is futile due to immense competition.[50] Instead, subcontractors should focus on "long-tail keywords"—longer, more specific phrases that indicate a user is closer to making a purchasing decision. These phrases have lower search volume but much higher intent and less competition.[51, 52] Examples include "commercial electrical subcontractor for government projects in Houston" or "certified HUBZone drywall installer in Virginia".[53, 54]

- Create Location and Service Pages: A well-structured website is fundamental to good SEO. Subcontractors should build dedicated pages for each distinct service they offer and for each major city or geographic area they serve. This structure allows them to rank for highly specific, location-based searches like "commercial plumbing contractor in Dallas," capturing qualified leads directly from their service area.[49]

The Pitch: Stop Hunting, Start Winning - The Future of Subcontracting is AI-Powered

The modern subcontractor faces an impossible dilemma. The playbook for success, as outlined, is exhaustive. A business is expected to cultivate deep personal networks at industry events, meticulously monitor five or more different government websites daily, pay for subscriptions to multiple private bidding platforms, maintain an active and engaging LinkedIn presence, and become an expert in local SEO. This is all expected to happen while simultaneously managing crews, ordering materials, ensuring safety, and delivering high-quality work on existing projects. This juggling act is not just difficult; it is a direct path to burnout and missed opportunities. The core problem is the fragmentation of information and the immense time required to manage it.

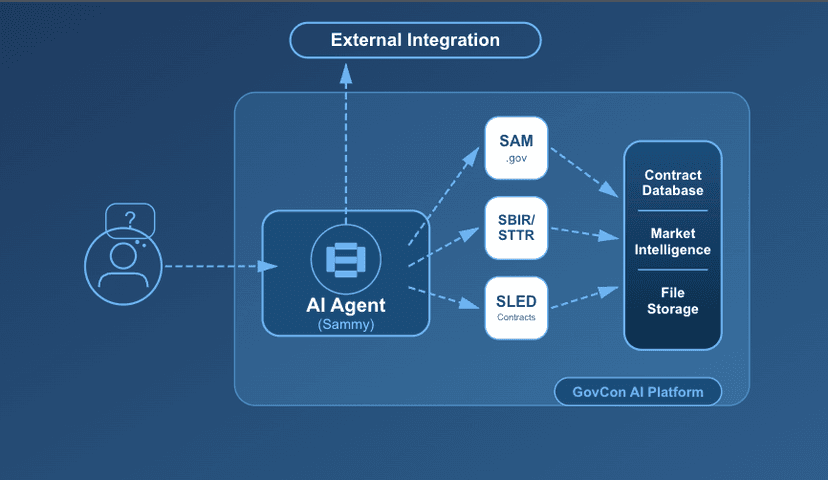

Introducing Samsearch: Your AI-Powered Partnership Engine

What if there was a single platform that could cut through this noise? What if technology could not only find opportunities but also intelligently identify the most promising strategic partners? That is precisely why Samsearch was built. It is designed to transform the chaotic hunt for work into a streamlined, data-driven process of building profitable partnerships.

The Samsearch advantage lies in its intelligent approach to connection. It offers a new way to find prime contractors who need specific services or identify subcontractors to help win larger contracts. Samsearch aggregates opportunities from a vast array of public and private sources, saving users dozens of hours of manual searching each week. But its true power lies in its ability to help build strategic partnerships and increase win rates with AI-powered matching.

This goes far beyond simple keyword alerts. Samsearch's proprietary AI analyzes a prime contractor's historical award data, their stated needs in official subcontracting plans, and a subcontractor's unique capabilities and certifications. It then identifies high-probability partnerships where a subcontractor's services are not just a fit, but a strategic necessity for the prime. It is not just a search engine; it is a matchmaking engine designed to foster the long-term, reliable relationships that are the bedrock of a successful subcontracting business.

How Samsearch Solves Your Biggest Problems

Samsearch directly addresses the most significant pain points that hold subcontractors back:

- Ends the Fragmentation: It provides a unified, single stream of relevant public and private opportunities, eliminating the need to log in to and monitor a dozen different websites.

- Saves You Time: It replaces hours of manual searching with intelligent, automated alerts tailored to a business's specific profile, freeing up valuable time to focus on bidding and execution.

- Boosts Your Win Rate: By focusing efforts on high-probability matches, it connects subcontractors with prime contractors who are actively and often legally required to find their specific skills and certifications.

- Facilitates Strategic Growth: It helps businesses move beyond the cycle of one-off, low-margin bids to build a sustainable pipeline of reliable work with trusted, long-term prime partners.

Conclusion: Your Roadmap to a Full Project Pipeline in 2025

Securing a consistent flow of profitable subcontracting work in the competitive 2025 market requires a multifaceted and strategic approach. The most successful firms will be those that build upon a solid foundation of traditional, relationship-based networking. They will master the complex digital tools and government portals that serve as the gateways to a vast number of opportunities. Critically, they will embrace the power of technology not just to find work, but to work smarter. By leveraging intelligent platforms to cut through the noise and identify the most promising partnerships, subcontractors can shift their focus from the exhausting hunt for the next job to the strategic work of building a resilient and thriving business.

The hunt for subcontracting work is over. It's time to start building strategic partnerships. Discover your next opportunity and your next long-term partner. Get started with Samsearch today.

About Samsearch

Samsearch is an all-in-one platform that streamlines the entire government contracting process. Our solution brings together discovery, management, compliance, and proposal drafting — eliminating the need for multiple disjointed government contracting softwares.