Discover the Different Types of Government Contracts: Fixed-Price, Cost-Reimbursement, and More

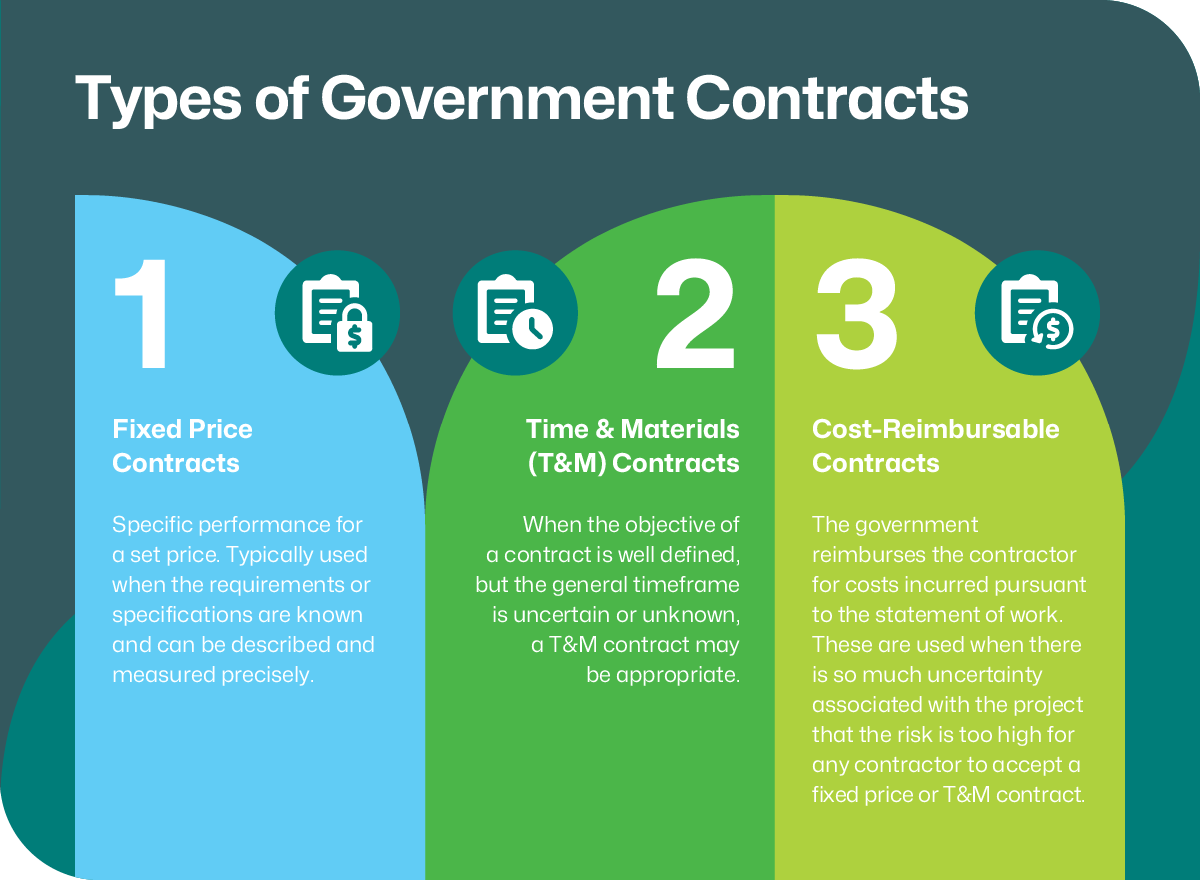

There are several types of government contracts, including fixed-price contracts for well-defined projects, cost-reimbursement contracts for research and development, time-and-materials contracts for flexible needs, and indefinite-delivery/indefinite-quantity (IDIQ) contracts for variable demands.

Importance of Understanding Different Contract Types

Different contract types determine how risks and responsibilities are allocated between the government and the contractor. They affect pricing structures, payment schedules, performance metrics, and compliance requirements. By understanding these variations, contractors can strategically bid on projects that align with their strengths and capabilities, ensuring they can meet the obligations without undue risk.

1. Fixed-Price Contracts

Fixed-Price Contracts set a firm, predetermined price for the contractor's performance. In this type of contract, the contractor agrees to deliver the specified goods or services at the agreed-upon price, regardless of the actual costs incurred during the project. This contractual agreement ensures that the price remains constant, providing financial predictability for the government entity engaging the contractor.

Advantages:

-

Predictable Costs: Fixed-Price Contracts provide clear and predictable costs for the government, simplifying budgeting and financial planning. This predictability helps in allocating resources efficiently and avoiding unexpected expenses.

-

Incentivizes Efficiency: Contractors are incentivized to manage their resources efficiently and control costs, as any savings directly benefit their bottom line. Efficient resource management and cost control can lead to increased profitability for contractors who can deliver under budget.

-

Administrative Simplicity: Fixed-Price Contracts often involve less administrative oversight and fewer audits compared to cost-reimbursement contracts, making them easier to manage.

Disadvantages:

-

High Risk for Contractors: Contractors bear the risk of cost overruns and unforeseen expenses. If the project costs more than anticipated, the contractor absorbs the additional costs, which can impact profitability. This risk can deter contractors from bidding on projects with uncertain scopes or potential for significant cost increases.

-

Potential for Lower Quality: To maintain profitability, contractors might cut corners or reduce quality if costs begin to overrun. This potential issue requires careful contract management and performance monitoring by the government.

-

Reduced Flexibility: Fixed-Price Contracts offer less flexibility to accommodate changes or modifications during the project. Any significant change in scope typically requires a new contract or a formal amendment.

Variants:

-

Firm-Fixed-Price (FFP): This variant sets a fixed price that is not subject to any adjustment based on the contractor's incurred costs or performance. It provides the maximum price certainty for the government and is commonly used for projects with well-defined scopes.

-

Fixed-Price with Economic Price Adjustment (FPEPA): This variant allows for adjustments to the fixed price based on specific economic conditions, such as inflation, changes in the cost of labor or materials, or other economic variables. It offers some flexibility to address significant cost fluctuations beyond the contractor's control, helping to mitigate financial risks associated with long-term projects.

-

Fixed-Price Incentive Fee (FPIF): This variant includes provisions for adjusting the contractor’s profit based on their performance in meeting specified cost, schedule, and technical targets. It incentivizes contractors to exceed performance criteria while providing some protection against cost overruns.

2. Cost-Reimbursement Contracts

Cost-Reimbursement Contracts reimburse the contractor for allowable and reasonable costs incurred during the performance of the contract. Unlike Fixed-Price Contracts, the final cost is not predetermined, allowing for flexibility in addressing uncertainties and unforeseen expenses. Contractors are reimbursed for all legitimate costs, and they may also receive an additional fee representing their profit.

Advantages:

-

Less Risk for Contractors: Contractors face less financial risk since they are reimbursed for all allowable costs, reducing the pressure to control expenses tightly. This type of contract is particularly beneficial for projects with uncertain or high-risk scopes, as it provides a safety net for contractors.

-

Flexibility: These contracts offer greater flexibility to accommodate changes in project scope or unforeseen conditions. This adaptability is crucial for complex, research-oriented, or development projects where requirements may evolve.

-

Encourages Innovation: Contractors may be more willing to pursue innovative solutions or take on challenging projects without the fear of incurring losses, as their costs will be covered.

Disadvantages:

Increased Oversight: Cost-Reimbursement Contracts require more stringent monitoring and oversight to ensure that only allowable costs are reimbursed. This increased administrative burden includes detailed audits and regular reporting, which can be resource-intensive.

Potential for Inefficiency: Since contractors are reimbursed for all costs, there may be less incentive to control expenses strictly, potentially leading to inefficiencies and higher overall project costs.

Variants:

-

Cost-Plus-Fixed-Fee (CPFF): This variant reimburses the contractor for all allowable costs and includes a fixed fee that is determined at the outset of the contract. The fixed fee does not change regardless of the actual costs incurred, providing some predictability for contractor profit while ensuring full cost recovery.

-

Cost-Plus-Incentive-Fee (CPIF): In this variant, the contractor is reimbursed for allowable costs and can earn an additional incentive fee based on achieving specific performance targets related to cost, schedule, or technical outcomes. This structure encourages contractors to perform efficiently and meet or exceed project goals.

3. Time-and-Materials (T&M) Contracts

Time-and-Materials (T&M) Contracts involve payment based on the actual hours worked by the contractor's employees and the materials used during the project. These contracts combine elements of both Fixed-Price and Cost-Reimbursement Contracts, providing flexibility in pricing while allowing for direct reimbursement of costs incurred.

Advantages:

-

Flexibility: T&M Contracts offer flexibility in managing projects where the scope or requirements are not well-defined upfront. They allow for adjustments to the project as it progresses, accommodating changes in scope, schedule, or technical requirements.

-

Transparent Billing: Since payment is based on actual hours worked and materials used, billing is transparent and directly linked to the work performed. This transparency can help build trust between the contractor and the government entity.

-

Suitability for Short-Term Projects: T&M Contracts are well-suited for short-term projects or those with variable workloads, where it may be challenging to accurately estimate costs upfront.

Disadvantages:

-

Potential for Cost Overruns: Without a predetermined price, there is a risk of cost overruns if the project takes longer than anticipated or if material costs increase unexpectedly. Contractors may be incentivized to prolong projects to maximize billing hours, potentially leading to higher overall costs.

-

Limited Cost Control: Since the contractor is reimbursed for actual costs incurred, there may be limited incentive to control expenses tightly, leading to inefficiencies and higher overall project costs. Effective cost management and oversight are essential to mitigate this risk.

Time-and-Materials Contracts offer a balance between the flexibility of Cost-Reimbursement Contracts and the simplicity of Fixed-Price Contracts. While they provide adaptability for projects with evolving requirements, careful monitoring and management are necessary to prevent cost overruns and ensure cost-effectiveness.

4. Incentive Contracts

Incentive Contracts are designed to motivate contractors to achieve specific performance targets by offering additional incentives or rewards based on their performance. These contracts introduce performance-based elements into the contracting structure, aligning the contractor's interests with project goals.

Advantages:

-

Encourages Efficiency: Incentive Contracts incentivize contractors to perform efficiently and achieve project objectives within budget and schedule constraints. By linking rewards to performance, these contracts encourage innovation, quality improvement, and cost savings.

-

Aligns Interests: Incentive Contracts align the interests of the contractor with those of the government entity, ensuring collaboration and shared accountability for project success. Contractors are motivated to meet or exceed performance targets to maximize their rewards.

-

Flexibility: These contracts offer flexibility in structuring incentives tailored to specific project goals and objectives, allowing for customization based on the nature of the project and the desired outcomes.

Disadvantages:

-

Complex to Administer: Incentive Contracts can be complex to administer, requiring detailed performance metrics, monitoring mechanisms, and evaluation criteria. The complexity increases the administrative burden on both parties and may necessitate additional resources for contract management and oversight.

-

Subjectivity in Evaluation: Evaluating performance and determining incentive payouts may involve subjective judgments, leading to potential disputes or disagreements between the contracting parties. Clear and objective performance criteria are essential to minimize ambiguity and ensure fairness in incentive determination.

-

Risk of Gaming the System: Contractors may attempt to manipulate performance metrics or outcomes to maximize their incentive rewards, potentially compromising project integrity or quality. Effective monitoring and oversight are necessary to detect and prevent such behavior.

Variants:

-

Fixed-Price Incentive (FPI): This variant combines elements of Fixed-Price Contracts with incentive provisions based on performance. Contractors receive a predetermined fixed price for their work, with additional incentives tied to achieving specified performance targets, such as cost savings, schedule adherence, or quality improvements.

-

Cost-Plus-Incentive-Fee (CPIF): In this variant, contractors are reimbursed for allowable costs and receive an additional incentive fee based on their performance in meeting specific cost, schedule, or technical objectives. The incentive fee is determined based on predefined performance criteria and can vary depending on the level of achievement.

Even though government contracts can be very lucrative, government contract work can also come with a lot of red tape and paperwork involved, which makes them very time-consuming. It is important to be aware of the different contract types when bidding on government contracts and to be prepared if you are awarded one.

About Samsearch

Samsearch is an all-in-one platform that streamlines the entire government contracting process. Our solution brings together discovery, management, compliance, and proposal drafting — eliminating the need for multiple disjointed government contracting softwares.