Complete Guide to AI for Government Contracting: Search, Analysis & Automation in 2026

Complete Guide to AI for Government Contracting: Search, Analysis & Automation in 2026

The Government Contracting Research Problem

Government contracting represents a $700+ billion annual market, yet finding the right opportunities remains frustratingly manual and time-consuming. Contractors spend countless hours navigating SAM.gov, analyzing spending patterns across multiple agencies, researching competitors, and identifying teaming partners.

The process involves juggling multiple databases-federal contracts, SLED opportunities, SBIR grants, DIBBS listings, and forecast data-each with different search interfaces and data formats.

Traditional research methods force teams to context-switch between platforms, manually export data, build spreadsheets, and piece together market intelligence from fragmented sources. By the time you've analyzed an opportunity, solicitation deadlines may have passed.

Small businesses and first-time contractors face an even steeper learning curve, often missing opportunities simply because they don't know where to look or what questions to ask.

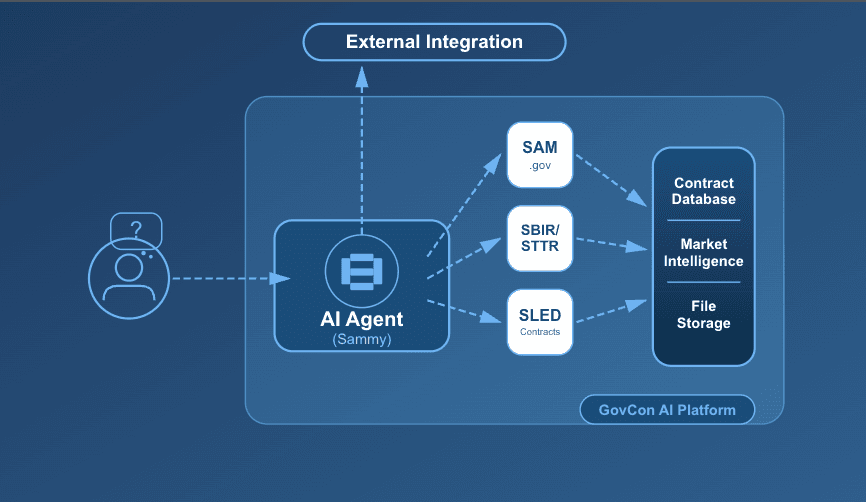

This is where AI agents are transforming government contracting in 2026. Meet Sammy.

What is Sammy? Your AI Agent for Government Contracting

Sammy is an AI-powered agent specifically designed for government contracting professionals. Unlike generic AI chatbots, Sammy combines advanced language understanding with direct access to government contracting databases, market intelligence tools, and analytical capabilities purpose-built for the GovCon ecosystem.

Sammy doesn't just answer questions-it actively searches federal contract databases, analyzes spending patterns, generates market reports, identifies teaming partners, and delivers actionable intelligence in seconds.

Think of Sammy as your 24/7 research analyst, business development assistant, and competitive intelligence specialist rolled into one.

🎥 Watch Sammy in action:

Whether you're a small business pursuing your first federal contract, a prime contractor seeking subcontracting partners, or a growth-stage company expanding into new agencies, Sammy handles the heavy lifting of market research and opportunity identification.

Ask. Sammy Acts.

Sammy doesn't just answer questions-it takes action. Here's how it works:

You ask: "Find me potential partners I can work with on this contract."

Sammy automatically:

- Activates its Partner Finder capability

- Analyzes the opportunity requirements

- Searches contractors with proven experience

- Presents qualified matches with relevant details

This is the power of an AI agent versus a simple chatbot. Sammy understands context, selects the right tools, and delivers actionable results.

Want to see Sammy analyze RFPs and documents? Check out our RFP Analysis tool where Sammy can instantly analyze government solicitations, attachments, and evaluation criteria through simple conversation.

Finding Hidden Contract Opportunities with AI

Federal Contract Discovery

Finding relevant federal opportunities across SAM.gov's massive database becomes effortless with Sammy's Federal Contracts Search capability. Instead of learning complex Boolean search syntax or navigating clunky government portals, you simply ask Sammy in natural language: "Show me recent cybersecurity contracts awarded by the Department of Defense under $10 million."

Sammy searches across active solicitations, recently awarded contracts, and contract modifications simultaneously. The AI understands government contracting terminology, NAICS codes, PSC codes, and set-aside categories without requiring you to memorize classification systems.

If you're tracking specific contract vehicles like GSA Schedule or IDIQ opportunities, Sammy filters results intelligently based on your criteria.

State, Local, and Education (SLED) Opportunities

The SLED market represents billions in opportunities often overlooked by contractors focused solely on federal work. Sammy's SLED Contracts Search spans state procurement portals, municipal bid systems, and educational institution contracts across all 50 states.

Finding opportunities across fragmented state systems traditionally requires visiting dozens of individual websites. Sammy consolidates this search into a single query.

Ask Sammy "What construction contracts are available in Texas and California over $500K?" and receive results from multiple state portals, formatted consistently and ranked by relevance to your capabilities. The AI identifies geographic opportunities aligned with your business footprint, helping you discover nearby contracts where local presence provides a competitive advantage.

SBIR and STTR Grant Discovery

Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs offer non-dilutive funding for technology development, but tracking solicitations across 11 participating agencies is overwhelming. Sammy's SBIR Contracts Search monitors topic releases from DOD, NIH, NASA, DOE, NSF, and other agencies, alerting you to relevant opportunities based on your technology focus.

Beyond simple keyword matching, Sammy analyzes topic descriptions to understand technical requirements and suggests relevant solicitations even when terminology doesn't match exactly.

If you're developing autonomous vehicle technology, Sammy identifies relevant opportunities across defense, transportation, and energy agencies, even when they use different technical terminology.

DIBBS and Forecasted Opportunities

Getting ahead of opportunities before they're formally solicited provides a massive competitive advantage. Sammy searches the Defense Industrial Base Business System (DIBBS) for upcoming DOD requirements and monitors agency forecast data to identify opportunities 6-18 months before solicitation release.

This early visibility allows you to begin teaming arrangements, develop past performance relationships, and position your solution before the competition even knows the opportunity exists. Sammy tracks forecast changes, alerting you when estimated solicitation dates shift or requirement descriptions are updated.

Subcontracting Opportunities

For small businesses, subcontracting often provides the fastest path to federal revenue and past performance. Sammy's Subcontracting Search identifies prime contractors with active contracts matching your capabilities, along with their subcontracting goals and historical subcontracting patterns.

Ask Sammy "Which prime contractors working on Air Force IT modernization contracts have small business subcontracting requirements?" and receive a targeted list of teaming opportunities. Sammy analyzes subcontracting plans from recent awards, identifying primes who haven't yet fulfilled their small business participation goals.

Analyzing Government Spending Patterns with AI

Spending Analysis and Trends

Understanding where agencies spend money, how much they spend, and with whom provides critical intelligence for market entry and capture strategy. Sammy's Spending Analysis capability processes historical contract award data to reveal patterns invisible in raw data.

Query Sammy with "Show me Department of Veterans Affairs cybersecurity spending trends over the past three years" and receive analysis of total obligations, award frequency, average contract size, and spending trajectory.

The AI identifies whether agencies are consolidating spend with fewer contractors or diversifying their vendor base, informing your positioning strategy.

Sammy breaks down spending by contract type (firm-fixed-price vs. cost-plus), set-aside category (small business, 8(a), woman-owned, etc.), and acquisition method (full and open vs. limited competition). This granular view reveals market dynamics that determine your probability of success.

Contract Details and Award Intelligence

Every contract award tells a story-about agency priorities, budget availability, evaluation criteria, and competitive landscape. Sammy's Contract Details capability extracts and synthesizes information from individual awards, including scope descriptions, period of performance, pricing structures, and performance locations.

For contracts of interest, Sammy pulls full award documentation, identifies key personnel and decision-makers, and highlights unique contract terms or requirements. This intelligence informs your capture strategy and proposal approach for similar upcoming opportunities.

Identifying Top Contractors and Competitive Intelligence

Knowing who wins in your target market is essential for competitive positioning and teaming strategy. Sammy's Top Contractors analysis identifies market leaders by agency, contract type, or capability area, along with their win patterns and competitive strengths.

Ask Sammy "Who are the top 10 contractors for Army logistics contracts?" and receive ranked results with award volumes, win rates, and contract examples.

The AI identifies whether these incumbents typically team with small businesses or self-perform, revealing potential teaming opportunities or areas where you'll face established competition.

Sammy also tracks new market entrants-companies recently winning their first contracts in specific areas-highlighting emerging competitors and potential teaming partners who are actively growing in your market.

Agency-Specific Analysis

Each federal agency has unique procurement patterns, preferred contract structures, and buyer behaviors. Sammy's Agency Analysis provides deep dives into individual agencies, revealing how they buy, what they prioritize, and where opportunities exist.

For agencies you're targeting, Sammy analyzes average procurement timelines, typical evaluation factors, protest rates, and small business utilization rates.

This intelligence helps you allocate business development resources to agencies where your solution and company profile align with historical buying patterns.

Market Insights and Opportunity Assessment

Beyond historical data, Sammy provides forward-looking Market Insights that combine spending trends, forecast data, and policy changes to identify emerging opportunities. The AI monitors budget announcements, strategic plans, and agency initiatives to predict where future spending will flow.

If the Department of Energy announces a major clean energy initiative, Sammy correlates this with historical spending patterns, identifies relevant NAICS codes and PSC codes, and estimates potential contract values and timing.

This predictive intelligence allows you to position proactively rather than react to solicitations.

Location-Based Market Analysis

Government contracts often include geographic requirements or preferences for local contractors. Sammy's Location Analysis identifies contracts awarded in specific regions, work performed at particular installations or facilities, and contractors with local presence in target areas.

For companies considering geographic expansion, Sammy analyzes contract volumes by state or metropolitan area, identifying markets with high contract activity aligned with your capabilities.

This data-driven approach to expansion planning reduces risk and identifies high-potential markets.

Notable Awards and Precedent Transactions

Certain contract awards signal market shifts, new buying patterns, or innovative procurement approaches. Sammy's Notable Awards tracking highlights significant contracts based on award size, innovative contract structures, new agency priorities, or first-time awards to non-traditional contractors.

These precedent transactions provide valuable intelligence for structuring your own proposals and understanding what agencies consider innovative or worthy of significant investment.

Award Details and Historical Context

For any specific award, Sammy provides comprehensive Award Details including the full procurement history-original solicitation, amendments, Q&A exchanges, protest outcomes, and modifications. This historical context reveals lessons learned from both winning and losing bidders.

Understanding why an agency chose a particular solution, contract structure, or vendor informs your strategy for similar opportunities.

Sammy connects dots across related awards, identifying patterns in agency decision-making that aren't apparent from single awards in isolation.

Advanced AI Reasoning and Analysis

Thinking and Analyzing Capabilities

Beyond search and data retrieval, Sammy applies advanced reasoning to government contracting problems. When you ask complex questions like "Should we pursue this opportunity as a prime or subcontractor?", Sammy doesn't just return data-it analyzes your situation using multiple factors.

The AI considers your past performance, incumbent advantage, technical capability gaps, teaming partner availability, and competitive landscape to provide reasoned recommendations.

Sammy explains its reasoning process, allowing you to understand the logic behind recommendations and adjust assumptions as needed.

For capture planning, Sammy analyzes solicitation requirements against your capabilities, identifying strengths to emphasize and gaps requiring teaming partners or subcontractors. This analysis accelerates capture decisions and ensures you pursue opportunities where you have realistic win probability.

Multi-Source Intelligence Synthesis

Government contracting decisions require synthesizing information from multiple sources-contract data, news about agency priorities, budget documents, and strategic plans. Sammy's reasoning engine connects information across these sources to provide comprehensive intelligence.

If you're evaluating whether to enter the Space Force market, Sammy analyzes historical Space Force contracts, recent news about budget increases, official strategic planning documents, and spending forecasts.

The AI identifies alignment between your capabilities and agency needs, providing a complete market entry assessment rather than disconnected data points.

Automated File Generation and Reporting

Exporting Contract Data

Once Sammy identifies relevant opportunities or analyzes market data, you need this intelligence in formats compatible with your workflows. Sammy's file generation capabilities export data in multiple formats without manual copying and pasting.

JSON File Generation

For developers integrating contract intelligence into applications or CRM systems, Sammy generates JSON files with structured contract data. This enables automated pipeline management, opportunity tracking, and integration with existing business systems.

CSV File Generation

Most business development teams work in Excel or Google Sheets for pipeline tracking and analysis. Sammy's CSV File Generator exports contract searches, spending analysis, and competitor intelligence in spreadsheet-compatible formats. These files include all relevant fields-contract numbers, award dates, contractors, values, descriptions-ready for filtering and analysis in your preferred tools.

PDF File Generation

For reporting to executives or sharing intelligence with teaming partners, Sammy generates PDF reports with formatted market analysis, opportunity summaries, and competitive intelligence. These professional reports eliminate hours of manual document creation and ensure consistent formatting across your organization.

Text File Generation

For integration with other AI tools, documentation systems, or simple record-keeping, Sammy exports Text Files with formatted contract intelligence and analysis summaries.

Web Intelligence and Current Information

News Search for Market Awareness

Government contracting success requires staying current on agency priorities, policy changes, and industry developments. Sammy's News Search monitors government contracting news, agency announcements, and industry publications for information relevant to your target markets.

Ask Sammy "What's happening with Air Force DevSecOps initiatives?" and receive recent news articles, agency announcements, and industry analysis about Air Force software development priorities. This current awareness ensures your positioning and messaging align with latest agency priorities.

Web Search for Research

Beyond specialized contracting databases, Sammy performs Web Search across the broader internet for information relevant to capture strategy, competitive intelligence, and market understanding. This includes company websites, capability statements, press releases, and technical resources.

URL Reader for Document Analysis

When you encounter relevant articles, agency guidance documents, or competitor materials, Sammy's URL Reader capability fetches and analyzes content from specific web pages. This allows Sammy to incorporate external information into its analysis and recommendations without requiring you to summarize documents manually.

Finding Teaming Partners with AI

One of the most challenging aspects of government contracting is identifying and vetting potential teaming partners. Large procurements often require capabilities no single company possesses. Small businesses need prime contractors to access larger opportunities. Primes need small business subcontractors to meet socioeconomic requirements.

Sammy's Partner Finder capability matches your requirements with potential teaming partners based on complementary capabilities, past performance, certifications, and geographic presence.

Describe the capabilities you need-"I need a CMMI Level 3 software development firm with Air Force experience and an active Secret facility clearance"-and Sammy identifies qualified candidates.

The AI goes beyond simple keyword matching by understanding capability relationships and analyzing past teaming patterns. If certain companies frequently team together or have complementary wins in target agencies, Sammy surfaces these proven partnerships as potential models.

AI for Government Contracting vs. Traditional Research Methods

Speed and Efficiency

Traditional government contracting research requires hours or days of manual database searches, data compilation, and analysis. A comprehensive market analysis might take a junior analyst a full week. Sammy delivers equivalent analysis in minutes, allowing your team to evaluate more opportunities and make faster strategic decisions.

Comprehensive Coverage

Human researchers can only monitor a limited number of sources. Federal contracts across dozens of agencies, SLED opportunities in 50 states, SBIR topics from 11 agencies, and forecast data from multiple systems creates information overload. Sammy monitors all sources simultaneously, ensuring you never miss relevant opportunities due to coverage gaps.

Consistency and Accuracy

Manual research quality varies with analyst experience, fatigue, and time pressure. Sammy applies consistent analytical frameworks and criteria to every query, eliminating variability in market intelligence quality.

Cost-Effectiveness

Hiring and training business development analysts costs $60,000-$100,000 annually per person. Multiple analysts are required to cover the breadth of sources Sammy monitors continuously. The AI agent provides enterprise-grade market intelligence at a fraction of traditional research costs.

24/7 Availability

Opportunities don't wait for business hours. Solicitations post on weekends. Forecast data updates overnight. Sammy works continuously, monitoring sources and alerting you to time-sensitive opportunities regardless of when they appear.

Frequently Asked Questions

Can AI search SAM.gov contracts?

Yes. Sammy searches SAM.gov contract award data and active solicitations through direct database access. The AI understands government contracting terminology, NAICS codes, and set-aside categories, allowing you to search using natural language rather than learning complex query syntax. Sammy retrieves federal contract information including contract numbers, award dates, values, descriptions, and contractor details.

How does AI analyze federal spending?

Sammy analyzes federal spending by processing historical contract award data to identify patterns, trends, and insights. The AI aggregates spending by agency, time period, contract type, contractor, and other dimensions to reveal market dynamics. Spending analysis includes total obligations, average contract values, award frequency, and year-over-year trends. Sammy identifies whether spending is increasing or decreasing, which contractors are gaining or losing market share, and how agencies structure their procurement approaches.

What is an AI agent for government contracting?

An AI agent for government contracting is an artificial intelligence system specifically trained and equipped with tools to assist with government contract research, analysis, and intelligence gathering. Unlike generic AI chatbots, these specialized agents access government databases, understand procurement terminology and regulations, and perform tasks like opportunity search, competitive analysis, and market research. Sammy is an AI agent purpose-built for the government contracting ecosystem.

Can AI find SBIR and STTR grant opportunities?

Yes. Sammy searches SBIR and STTR solicitations across all participating federal agencies. The AI monitors topic releases from DOD, NIH, NASA, DOE, NSF, and other agencies, identifying opportunities relevant to your technology focus. Sammy analyzes topic descriptions to understand technical requirements and suggests relevant solicitations based on capability alignment rather than just keyword matching.

How can AI help find teaming partners for government contracts?

Sammy's Partner Finder capability identifies potential teaming partners by analyzing contractor capabilities, past performance, certifications, geographic presence, and historical teaming patterns. You describe the capabilities, certifications, or characteristics you need in a partner, and Sammy matches these requirements against contractor databases to identify qualified candidates. The AI considers complementary capabilities and proven teaming relationships when suggesting potential partners.

Can AI track government contract forecasts?

Yes. Sammy monitors agency forecast data and DIBBS (Defense Industrial Base Business System) to identify opportunities before formal solicitation. The AI tracks forecasted requirements 6-18 months in advance, providing early visibility into upcoming procurements. Sammy also monitors forecast changes, alerting you when estimated solicitation dates shift or requirement descriptions are modified.

What file formats can AI generate for contract data?

Sammy generates contract data exports in multiple formats including JSON (for application integration), CSV (for spreadsheet analysis), PDF (for professional reports), and text files (for documentation). This allows you to use contract intelligence in your preferred tools and workflows without manual data entry.

Can AI analyze spending by specific federal agencies?

Yes. Sammy performs agency-specific spending analysis, breaking down how individual agencies procure goods and services. Agency analysis includes total spending, procurement patterns, average timelines, typical contract structures, small business utilization rates, and top contractors. This intelligence helps you understand agency-specific buying behaviors and identify where your solution and company profile align with agency procurement patterns.

How does AI help with SLED (state and local) contract search?

Sammy searches state, local, and educational institution procurement portals across all 50 states, consolidating fragmented SLED opportunities into unified search results. Instead of visiting dozens of individual state procurement websites, you query Sammy using natural language and receive opportunities from multiple jurisdictions formatted consistently. The AI identifies geographic opportunities aligned with your business locations and capabilities.

Can AI identify subcontracting opportunities?

Yes. Sammy's Subcontracting Search identifies prime contractors with active contracts matching your capabilities, along with their subcontracting requirements and goals. The AI analyzes subcontracting plans from recent awards to find primes who need small business partners in specific capability areas. This helps small businesses identify teaming opportunities with established primes working on relevant contracts.

How current is AI contract data?

Sammy accesses current government contracting databases and can perform real-time web searches for the latest information. For questions about recent developments, policy changes, or breaking news affecting government contracting, Sammy searches the web to provide up-to-date information beyond its training data. This ensures you receive current intelligence rather than outdated information.

Can AI help with competitive intelligence?

Yes. Sammy provides competitive intelligence by analyzing contractor win patterns, market share, past performance, and teaming relationships. The AI identifies top contractors in specific markets, tracks emerging competitors, and reveals which companies are winning similar contracts in your target agencies. This intelligence informs competitive positioning and helps you understand the competitive landscape for opportunities you're pursuing.

Does AI understand government contracting terminology?

Yes. Sammy is specifically trained on government contracting terminology including NAICS codes, PSC codes, contract types, set-aside categories, acquisition methods, and procurement regulations. You don't need to memorize classification systems or use precise technical terminology-the AI understands natural language questions and translates them into appropriate searches.

What to Ask Your AI Agent: Sample Queries for Sammy

One of the most powerful aspects of AI agents like Sammy is the ability to ask questions in natural language, just as you would ask a colleague or analyst. You don't need to learn complex database syntax or navigate multiple government portals. Here are example queries that demonstrate Sammy's capabilities across different use cases:

Opportunity Discovery Queries

- "Show me all cybersecurity contracts awarded by the Department of Defense in the last 6 months over $5 million"

- "Find active solicitations for cloud migration services with responses due in the next 30 days"

- "What SBIR topics related to artificial intelligence are currently open across all agencies?"

- "Search for 8(a) set-aside contracts in NAICS code 541512 awarded in 2024"

- "Find construction contracts in Texas and Florida over $1 million"

- "What IT modernization opportunities are forecasted for the VA in the next 12 months?"

- "Show me recent awards for software development using Agile methodologies"

- "Find all GSA Schedule contracts for professional services awarded this quarter"

- "What IDIQ contracts are currently open for task order submissions in cyber?"

- "Search for subcontracting opportunities on Army logistics contracts"

Market Analysis Queries

- "Analyze Department of Homeland Security spending on border technology over the past 3 years"

- "What's the average contract value for NASA engineering services contracts?"

- "Show me spending trends for DISA cybersecurity from 2022 to 2024"

- "Which agencies increased their cloud computing spending the most last year?"

- "Compare Air Force vs. Navy spending on unmanned systems"

- "What percentage of DOE contracts go to small businesses?"

- "Analyze contract award timelines for the Department of State"

- "Show me the total addressable market for medical device contracts across VA and DOD"

- "What's the growth rate for artificial intelligence contracts government-wide?"

- "Identify agencies with declining IT spending that might indicate budget challenges"

Competitive Intelligence Queries

- "Who are the top 10 contractors for Space Force satellite communications?"

- "Show me all contracts awarded to [competitor name] in the last year"

- "Which small businesses recently won their first Army contracts over $10 million?"

- "What companies are winning DevSecOps contracts at the Air Force?"

- "Analyze the win rate for new entrants in DHS cybersecurity over 3 years"

- "Who are the incumbent contractors on Army network modernization programs?"

- "Which primes frequently team with small businesses on Navy shipbuilding?"

- "Show me companies that won protests against [competitor name]"

- "What contractors transitioned from subcontractor to prime in the VA market?"

- "Identify the fastest-growing contractors in federal cloud services"

Teaming and Partnership Queries

- "Find CMMI Level 3 software companies with active Secret facility clearances"

- "Which prime contractors on Air Force contracts have unfulfilled small business subcontracting goals?"

- "Show me woman-owned businesses with DHS past performance in biometrics"

- "Find potential teaming partners in California with GSA Schedule 70"

- "Which contractors frequently partner together on DOE environmental remediation?"

- "Identify service-disabled veteran-owned businesses doing cyber work for DISA"

- "Find companies with both FedRAMP authorization and VA past performance"

- "Show me contractors with Navy SeaPort-e contracts seeking small business partners"

- "What 8(a) firms have experience with FAA air traffic control systems?"

- "Find HUBZone businesses in Virginia doing IT work for federal agencies"

Strategic Planning Queries

- "Should we pursue this opportunity as a prime or find a prime partner?"

- "What agencies should we target based on our cybersecurity and cloud capabilities?"

- "Analyze the competitive landscape for upcoming Air Force enterprise IT contract"

- "What certifications or past performance do we need to win DHS contracts?"

- "Compare our win rate to market averages in our NAICS codes"

- "Which geographic markets have the highest contract volume for our services?"

- "What's the typical proposal timeline for full and open DHS procurements?"

- "Identify agencies where our current past performance is most relevant"

- "Should we invest in FedRAMP authorization based on market opportunities?"

- "What capabilities are we missing compared to top contractors in our target market?"

SBIR/STTR Specific Queries

- "Find all open SBIR topics related to quantum computing"

- "What Navy SBIR topics align with our autonomous vehicle technology?"

- "Show me Phase II SBIR awards in energy storage from the past 2 years"

- "Which agencies have the highest SBIR approval rates for first-time applicants?"

- "Find STTR opportunities requiring university partnerships in biotechnology"

- "What's the average award amount for DOD Phase I SBIR in AI/ML?"

- "Show me upcoming NSF SBIR topics in clean energy technology"

- "Which SBIR topics have moved from Phase II to Phase III contracts?"

- "Find agencies with rapid SBIR timelines from submission to award"

- "What commercialization success rates exist for SBIR awards in our technology area?"

Current Intelligence Queries

- "What recent news affects Defense spending on hypersonic technology?"

- "Has the VA announced any new procurement initiatives this month?"

- "What policy changes impact small business set-aside requirements?"

- "Find recent protests on contracts similar to the opportunity we're pursuing"

- "What did the President's budget request say about NASA technology development?"

- "Are there any new executive orders affecting federal procurement?"

- "What recent inspector general reports mention contracting issues at DHS?"

- "Has [agency name] released any strategic plans relevant to our capabilities?"

- "What congressional testimony discusses future requirements in our market?"

- "Find recent GAO reports on [specific program or initiative]"

Data Export and Reporting Queries

- "Export the last 50 Air Force cyber contracts to CSV"

- "Generate a PDF report on VA telehealth spending trends"

- "Create a JSON file of all active solicitations matching our capabilities"

- "Export top contractors in our target agencies to a spreadsheet"

- "Generate a market analysis report for our executive team on DOE opportunities"

- "Create a CSV of potential teaming partners with their contact information"

- "Export spending analysis by agency for our business development pipeline"

- "Generate a competitive intelligence report on our top 3 competitors"

- "Create a text file summary of upcoming forecast opportunities"

- "Export SBIR topic descriptions for our R&D team to review"

Advanced Multi-Step Analysis Queries

- "Analyze the Space Force market, identify top contractors, find teaming opportunities, and recommend our positioning strategy"

- "Find all DHS border technology contracts, analyze spending trends, identify incumbents, and suggest which upcoming opportunities we should pursue"

- "Research the Army's cloud migration initiatives, find related contracts and forecasts, identify potential partners, and create a capture plan outline"

- "Compare our past performance to winning contractors in our target market and identify gaps we need to address"

- "Map out the competitive landscape for [specific program], including primes, subs, spending, and recent awards, then recommend teaming strategies"

Getting Started with Sammy

Government contracting success increasingly depends on information advantage-knowing about opportunities earlier, understanding markets more deeply, and making faster strategic decisions. Sammy provides this advantage by combining AI intelligence with comprehensive government contracting data access.

Whether you're pursuing your first federal contract or managing a portfolio of government business, Sammy handles the market intelligence workload that traditionally required teams of analysts. The result is faster opportunity identification, more informed strategic decisions, and better use of your business development team's time.

Start leveraging AI for government contracting with Sammy and transform how you find opportunities, analyze markets, and compete for government business.

Sammy is your AI-powered government contracting intelligence agent. Access federal contracts, SLED opportunities, SBIR grants, spending analysis, and competitive intelligence through natural language conversation. Get the market intelligence you need to win more government contracts.