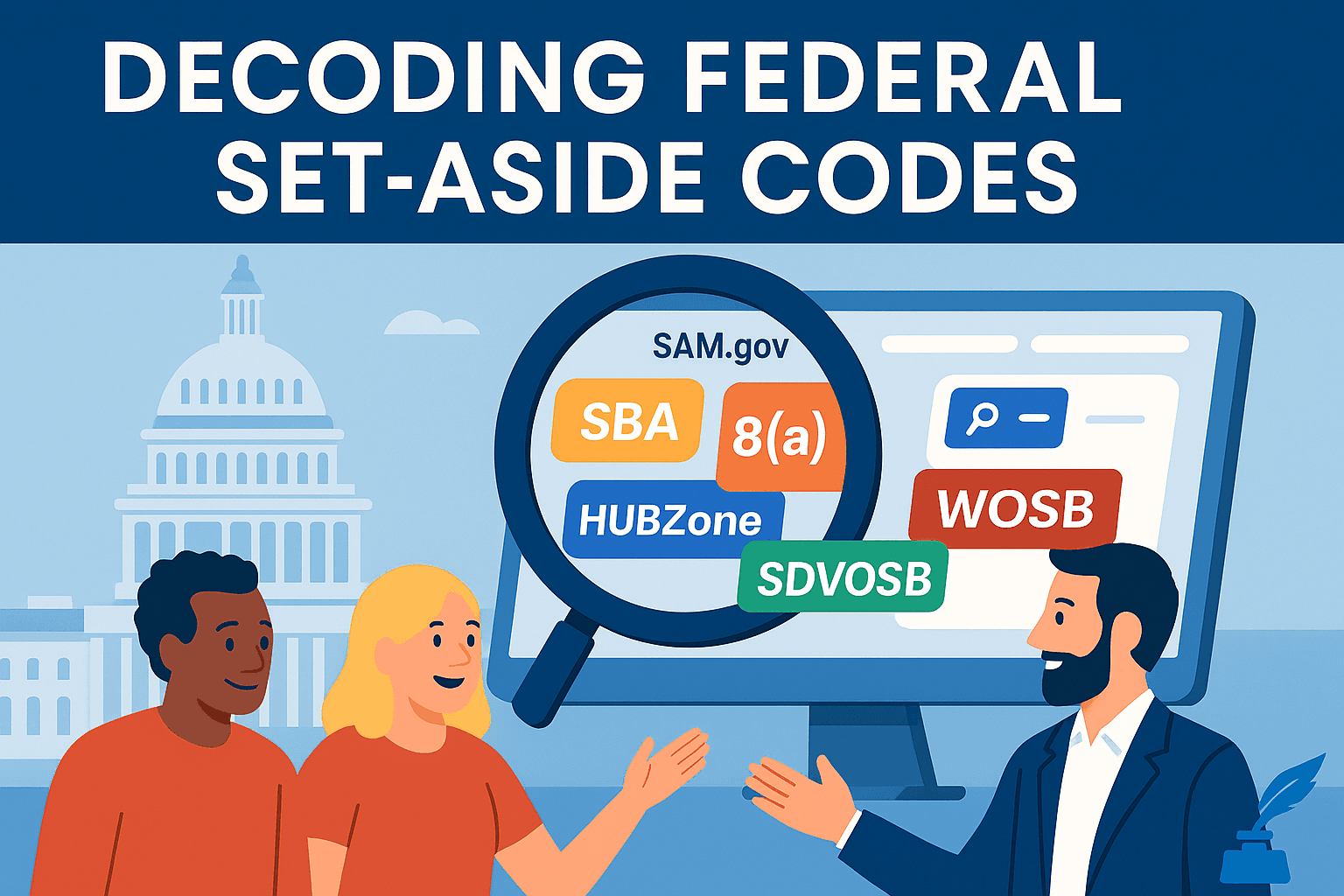

Government Set-Aside Codes: What You MUST Know

Quick read: Learn what each set‑aside code on SAM.gov means, how to qualify, and proven tactics to turn those codes into contracts.

1. Why Set‑Asides Matter

Federal law reserves a meaningful share of procurement dollars for small businesses. Contracting officers use “type of set‑aside” codes (e.g., SBA, 8A, HZC) to signal which socioeconomic program can compete or whether a contract is totally or partially set aside. Knowing the code—and what it unlocks—helps you target opportunities, tailor proposals, and stay compliant.

2. At‑a‑Glance: Common Set‑Aside Codes

| Code | Meaning | Core Statute/FAR Part |

|---|---|---|

| SBA | Small Business Set‑Aside (Total) | FAR 19.502‑2 |

| SBP | Small Business Set‑Aside (Partial) | FAR 19.502‑3 |

| 8A | 8(a) Competitive | FAR 19.805‑2 |

| 8AN / 8A‑Sole | 8(a) Sole Source | FAR 19.808‑1 |

| HZC / HZS | HUBZone Competitive / Sole Source | FAR 19.1305 & 19.1306 |

| SDVOSBC / SDVOSBS | Service‑Disabled Veteran‑Owned Small Business Competitive / Sole Source | FAR 19.1405‑06 |

| WOSB / EDWOSB | Women‑Owned & Economically Disadvantaged Women‑Owned | FAR 19.1505 |

| BI | Buy Indian | 25 U.S.C. 47, DIAR 1480.402 |

| VSA / VSS | Veteran Set‑Aside / Veteran Sole Source (VA‑only) | VAAR 819.7005 |

| NONE | No set‑aside used | — |

Tip: On SAM.gov, filter “Type of Set‑Aside” to see only the codes that match your certifications.

3. Socio‑Economic Programs in Depth

3.1 8(a) Business Development

- Who qualifies? Small businesses that are both socially and economically disadvantaged, with < $7 M average annual receipts for most NAICS.

- How to apply: Certify via SBA Certify platform; prepare narrative of disadvantage, two years of financials, and business plan.

- Insider tips

- Leverage the annual review to update NAICS and primary business code.

- Use 8(a) sole‑source authority for emergency or niche procurements (up to $7 M manufacturing / $4.5 M services).

- Monitor the Bona‑Fide Place of Business moratorium (extended through Sept 30 2025)—this waives geographic restrictions for construction.

3.2 HUBZone

- Who qualifies? Principal office in a qualified HUBZone + 35 % of employees living in a HUBZone.

- Certify: Upload payroll, lease, and map confirmation to SBA Connect.

- Pro tips

- Check the new HUBZone map (last major update July 1 2023); addresses can shift in/out annually.

- Agencies must consider HUBZone before unrestricted if ≥ 2 eligible firms respond.

3.3 Service‑Disabled Veteran‑Owned (SDVOSB)

- Who qualifies? ≥ 51 % owned & controlled by one or more service‑disabled vets; permanent disability not required.

- New in 2023: Certification moved from VA to SBA; reuse your VetCert account.

- Contracting nuggets

- Below $250 k, contracts are automatically small‑business set‑asides—request the CO restrict further to SDVOSB when two or more are available.

- VA may still use Veteran Set‑Aside (VSA) code for non‑SDV veteran firms.

3.4 Women‑Owned & EDWOSB

- Who qualifies? ≥ 51 % owned & controlled by women; EDWOSB adds personal net worth ≤ $850 k (excluding home & retirement).

- Target industry list: Over 700 NAICS where women are under‑represented; find the official PDF and tag these codes in SAM registration.

- Pitch tip: Cite the agency‑wide 5 % WOSB goal in your capability statement.

3.5 Total & Partial Small‑Business Set‑Asides (SBA/SBP)

- Automatic under the simplified acquisition threshold (SAT, currently $250 k)—unless the CO documents reason otherwise.

- Partial set‑aside: CO can carve out a portion of a large contract that small businesses perform.

3.6 Buy Indian Act (BI)

- Scope: Used only by DOI & Indian Health Service for Indian‑owned enterprises.

- Key doc: DIAR 1480.504 outlines priority among preference programs.

4. Compliance Essentials

- Limitations on Subcontracting – Prime must self‑perform 50 % (services) / 15 % (construction) or follow 13 CFR 125.6.

- NAICS & Size Standards – Verify size at time of offer; recertify for long‑term IDIQs when required.

- Joint Ventures & Mentor‑Protégé – JV inherits protégé’s status; file JV agreement with SBA before offer.

- Misrepresentation – False claims can trigger suspension, debarment, or even criminal penalties.

5. Hunting for Set‑Aside Opportunities

- Use SAM.gov advanced search → Type of Set‑Aside filter.

- Subscribe to Dynamic Small Business Search (DSBS) email alerts.

- Check agency Forecasts of Contracting Opportunities early in the fiscal year.

6. Pitch‑Winning Tips

| Tip | Why It Works |

|---|---|

| Highlight your set‑aside code in the subject line | Busy COs scan emails; codes immediately signal eligibility. |

| Quote the agency’s small‑business scorecard | Shows you know their pain point and goal shortfalls. |

| Bundle capabilities with larger primes | Helps meet limitation on subcontracting while learning the ropes. |

| Update capability statement every quarter | Reflects any new certifications, NAICS, or past performance. |

7. Key Resources

- SBA Certify Portal: https://certify.sba.gov

- FAR Part 19: https://www.acquisition.gov/far/part-19

- HUBZone Map: https://maps.certify.sba.gov/hubzone/map

- Limitations on Subcontracting: 13 CFR 125.6

Disclaimer: Regulations change. Always check the latest Federal Acquisition Regulation (FAR) and SBA rules before bidding.

About Samsearch

Samsearch is an all-in-one platform that streamlines the entire government contracting process. Our solution brings together discovery, management, compliance, and proposal drafting — eliminating the need for multiple disjointed government contracting softwares.