The SBA Ecosystem: How to Leverage Capital, Counseling, and Contracting for Growth

The SBA Ecosystem: How to Leverage Capital, Counseling, and Contracting for Growth

While capital is the fuel for a business, strategy is the engine and steering wheel. The SBA's second pillar-counseling-provides this critical guidance at little to no cost. Many businesses fail not from a lack of funding, but from operational and strategic missteps such as poor financial management, ineffective marketing, or an inability to scale properly. The SBA's resource partner network is a powerful "soft infrastructure" designed to mitigate these non-financial risks.

This approach is fundamentally synergistic. The loan programs address the symptom-cash flow shortages-while the counseling programs address the root causes of business distress, such as managerial deficits. By providing expert guidance alongside capital, the SBA creates a more resilient entrepreneurial ecosystem, effectively acting as an insurance policy on its own loan portfolio. Engaging with a mentor before seeking a loan can significantly strengthen a business plan and financial projections, increasing both the likelihood of approval and the long-term success of the venture.

I. Your Free Personal Board of Advisors

The SBA funds a nationwide network of resource partners, creating a readily accessible, expert brain trust for entrepreneurs seeking guidance on virtually any aspect of business management.

Meet the Core Four Resource Partners

This network is comprised of four main organizations, each with a slightly different focus but a shared mission to empower small businesses.

-

Small Business Development Centers (SBDCs): Hosted by universities and state economic development agencies, SBDCs deliver professional, high-quality, and individualized business advising. Their consultants help with business planning, financial management, technology adoption, marketing strategies, and more.

-

SCORE: As the nation's largest network of volunteer, expert business mentors, SCORE connects entrepreneurs with experienced executives and business owners. These mentors provide ongoing, confidential advice on specific challenges and opportunities, all at no cost.

-

Women's Business Centers (WBCs): This network focuses on the unique challenges and opportunities faced by women entrepreneurs. WBCs provide targeted training, counseling, networking events, and resources to help women start, grow, and scale their businesses in a supportive environment.

-

Veterans Business Outreach Centers (VBOCs): VBOCs are dedicated to serving transitioning service members, veterans, and military spouses. They provide specialized assistance, including workshops like "Boots to Business," to help members of the military community translate their skills into successful entrepreneurship.

The Data-Backed Impact of Mentorship

The value of this counseling is not merely anecdotal; it is backed by compelling data demonstrating a significant return on investment for both the business owner and the taxpayer.

-

Drastically Improved Survival Rates: The impact on business longevity is profound. A survey found that 70% of small businesses that received mentoring survived for five years or more-a rate double that of non-mentored businesses. This single statistic makes a powerful case for engaging with a mentor early and often.

-

A Powerful Economic Engine: The counseling provided by these partners generates tangible economic growth. A comprehensive impact study of the SBDC network found that its long-term clients created over 85,000 new jobs and generated $10.1 billion in sales. The program returned an estimated $2.67 in federal and state tax revenues for every $1 of its operational cost, proving it is a high-yield investment in the national economy.

-

Enhanced Access to Capital: There is a direct and quantifiable link between the Counseling and Capital pillars. The same SBDC study revealed that clients secured $7.7 billion in financing after receiving counseling. Mentors help entrepreneurs refine their business plans, prepare financial documents, and present a more compelling case to lenders, effectively making their businesses more "bankable."

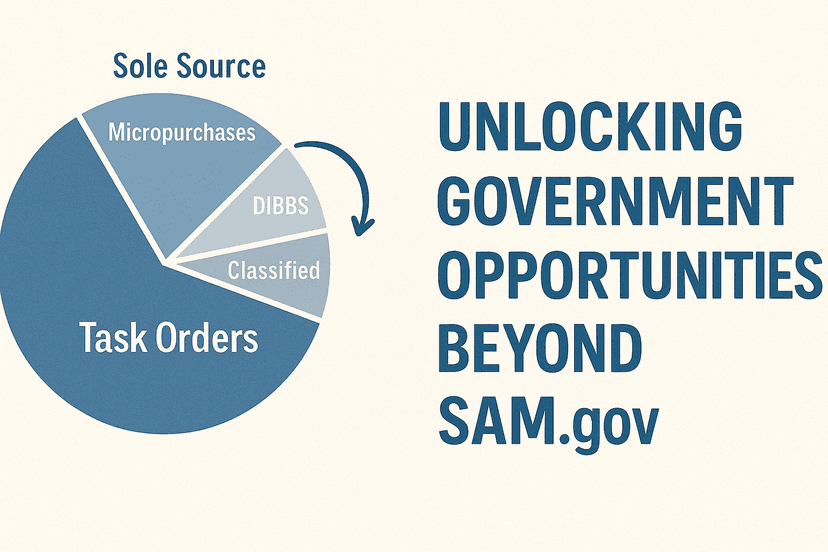

II. The Ultimate Growth Engine: Winning Your Share of the $700B+ Government Market

For established businesses ready to scale, the SBA's third pillar offers the single greatest growth opportunity: selling to the U.S. federal government. The government is the largest customer in the world, purchasing everything from IT services and construction to office supplies and marketing expertise. More importantly, it is required by law to award a significant portion of its contracts to small businesses.

The 23% Mandate: Your Foot in the Door

Congress has set a government-wide goal to award at least 23% of all prime federal contracting dollars to small businesses each year. This is not a token amount. In fiscal year 2024, this mandate translated into a record-breaking $183.27 billion awarded directly to small businesses, representing 28.78% of all federal prime contracts. This policy creates a protected, high-potential market where small firms can compete on a more level playing field.

Leveling the Playing Field with Set-Aside Programs

To ensure these goals are met, the government "sets aside" certain contracts exclusively for small businesses, drastically reducing the competition. Furthermore, specific sub-goals are established for businesses in certain socio-economic categories.

| Program Name | Target Audience | Federal Goal | Key Benefit |

|---|---|---|---|

| 8(a) Business Development | Socially and economically disadvantaged firms | 5% | Access to sole-source contracts and a 9-year mentorship program. |

| Women-Owned Small Business (WOSB) | Women-owned firms in eligible industries | 5% | Levels the playing field in industries where women are underrepresented. |

| Service-Disabled Veteran-Owned (SDVOSB) | Firms owned by veterans with a service-connected disability | 3% | Honors military service with preferential access to contracts. |

| HUBZone Program | Firms located in Historically Underutilized Business Zones | 3% | Encourages economic development in distressed communities. |

III. From Opportunity to Execution: Bridging the Gap

While the opportunity is immense, the federal marketplace is notoriously complex. Success is often determined less by being the "best" business and more by being the best at navigating the system.

The most common pain points include:

-

Lack of Resources & Expertise: Small firms rarely have dedicated teams to navigate bidding and compliance.

-

Regulatory Burden: Navigating the Federal Acquisition Regulation (FAR) can be overwhelming.

-

Finding Opportunities: Sifting through thousands of listings on SAM.gov is time-consuming.

-

The "Who" Problem: Even with a great product, finding the right human contact inside an agency to advocate for your business is difficult.

The Solution: Your GovCon Navigator

This disconnect between opportunity and execution has created a distinct need for specialized tools that can simplify the process and democratize access to the market the SBA has fostered. Samsearch provides these critical navigation aids, addressing the specific friction points that hold small businesses back.

1. Locate Opportunities with AI

For businesses struggling to find the right opportunities in a sea of data, Samsearch's contract search and analytics can filter and identify relevant solicitations with greater efficiency.

2. Clarify Codes with NAICS AI Lookup

For those confused by the government's system of industry codes, Samsearch's NAICS AI Lookup provides instant clarity, ensuring proposals are correctly categorized.

3. Build a Winning Brand

To create a professional and compliant "business resume" that gets noticed by procurement officers, Samsearch's Capability Statement Builder offers a purpose-built solution.

4. Connect with the Right People: The Small Business Specialists Directory

New Feature

Perhaps the most critical barrier in government contracting is the lack of human connection. To solve this, Samsearch has launched the Small Business Specialists Directory-a comprehensive tool designed to connect you directly with the agency insiders whose job it is to help you.

Instead of sending emails into a void, this directory allows you to:

-

Access Direct Contact Information: Unlock comprehensive contact info (phone numbers, emails, office locations) for specialists across all government departments and agencies.

-

Filter by Department & Agency: Easily find the specific specialist assigned to your target agency, whether it's the DoD, NASA, or the Department of Energy.

-

Get Compliance & Regulatory Help: Connect with experts who provide personalized help with compliance, certifications, and set-aside programs.

-

Uncover Subcontracting Opportunities: Find specialists who can guide you toward subcontracting partnerships with large prime contractors.

Click here to access the Samsearch Small Business Specialists Directory

IV. Your SBA Action Plan: Three Steps to Start Today

Navigating the SBA's resources can feel overwhelming. The key is to start with a focused, actionable plan based on a business's current stage and most pressing needs.

Step 1: Conduct a Strategic Self-Assessment

Identify your single most critical need. Is it Capital, Counseling, or Contracts? This simple assessment will provide a clear focus for initial efforts.

Step 2: Connect with Your Local Resource Network

Use the SBA's Local Assistance Finder to locate the nearest SBDC, SCORE chapter, WBC, or VBOC. Schedule a no-cost introductory call.

Step 3: Gauge Your GovCon Potential

For businesses considering the contracting pillar, use Samsearch's free tools as a discovery mechanism. Use the Small Business Specialists Directory to find a contact at a relevant agency and ask about their specific needs, or use the AI Search to browse active contracts. This research provides a low-stakes way to gauge the potential of the federal market.

V. Frequently Asked Questions

Q1: Are SBA loans easier to get than traditional bank loans?

A: They are not "easier," but they are more accessible. The SBA guarantee allows lenders to be flexible on collateral and credit history, though the paperwork is rigorous.

Q2: How much does SBA mentorship from SCORE or an SBDC cost?

A: In almost all cases, one-on-one counseling from SBA resource partners is completely free.

Q3: How do I find the right person to talk to at a government agency?

A: You should contact the agency's Office of Small and Disadvantaged Business Utilization (OSDBU) or a Small Business Specialist. You can find their direct contact information, filtered by agency, using the Samsearch Specialist Directory.

Q4: Can my business qualify for more than one SBA set-aside program?

A: Yes. A business can hold multiple certifications (e.g., WOSB and HUBZone) simultaneously, significantly expanding its contracting opportunities.

Q5: Do I need to win a prime contract to benefit from the GovCon ecosystem?

A: No. Subcontracting is a massive opportunity. The government requires large primes to subcontract to small businesses. You can find help navigating these partnerships through the specialists listed in the Samsearch directory.